Gearing up against greenwashers: investors seek clarity on sustainability terminology

A dearth of clear, agreed sustainability definitions present a challenge to investors looking to invest sustainably.

This is according to the results of the Schroders Institutional Investor Study, which surveyed 650 institutional investors across 26 countries during April 2020.

Gearing up against greenwashers

Greenwashing is about falsely communicating the environmental benefits of a product or service in order to make an entity seem more environmentally-friendly than it really is.

The majority of surveyed institutional investors cite greenwashing as the biggest impediment to sustainable investing.

Hannah Simons, Head of Sustainability Strategy, said: “The astonishing growth of sustainable investing over the last few years has seen a vast range of new ideas and products come to market. With new approaches comes new jargon but definitions are not always clear.

We’re committed to providing clarity on the fast-evolving sustainability landscape. To help with this we have written articles which define the key terms and explain the different approaches to sustainable investing: Everything you need to know about sustainable investing and 50 terms every sustainable investor should understand.”

Best-in-class and active ownership in greater demand

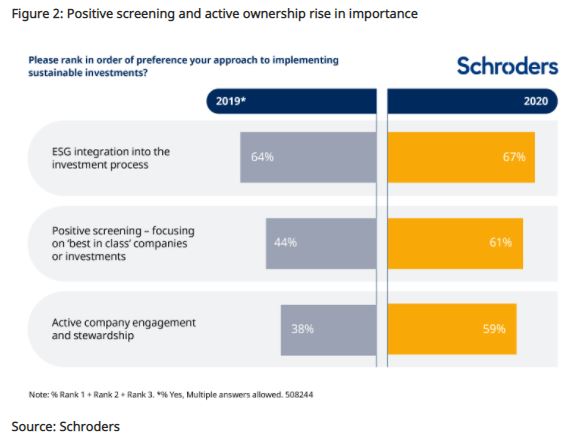

It’s striking to see what the difference one year can make to investor demand.

For example, while the majority of institutional investors (67%) said that integrating sustainability into the investment process was their preferred approach, demand for positive screening (which focuses on best in class companies or investments), and active company engagement, has accelerated between 2019 and 2020.

Elly Irving, Schroders Head of Engagement, said:“Active ownership has become more important than ever. Investors have a duty to hold companies accountable and an opportunity to drive positive change. It’s why Schroders has such a strong commitment to active ownership, demonstrated by our 20 year history. By engaging with companies and using our voting rights, we can drive sustainable change to better meet the investment needs of our clients.

“As we close in on 100% integration across all of our assets, engagement has evolved from a Sustainable Investment Team activity, to an investor-driven activity that’s becoming prevalent across the whole firm. We have achieved this through enhancing our infrastructure to support the engagement efforts of our fund managers and analysts which allows us to track, monitor and communicate progress effectively.”

Fewer challenges to sustainable investing

Positively, the study suggests that the proportion of sustainability sceptics is on the decline and that investors find sustainable investing less of a challenge than in previous years. In 2020, 70% of respondents said they found sustainable investing challenging in 2020, down from 77% in 2017.

This year, 45% of global institutional investors cited performance concerns as a challenge of sustainable investing. This figure has dropped since 2018 where more than 50% of respondents cited performance concerns as their top challenge.

At the same time, there has also been an impressive reduction in investors who don’t believe in sustainable investments. In 2017, 18% of investors held this view but today that figure has almost halved to 11%.

Only 13% of respondents do not invest in sustainable investments, down from 19% in 2019.

Potential for better performance attracts some investors…

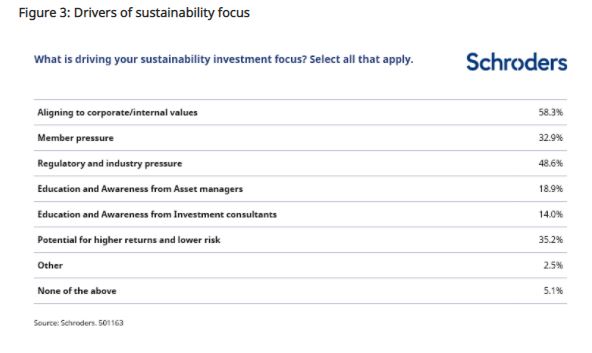

We also asked why institutional investors are investing sustainably.

For the majority of respondents (58%) it’s about aligning to corporate/internal values with regulatory and industry pressure in second place (49%).

However, a significant proportion (35%) of institutional investors invest sustainably because they believe there’s potential for higher returns and lower risk. Findings were similar in the individual investor survey (the Schroders Global Investor Study): 42% of respondents are attracted to sustainable investing because they believe they’re more likely to offer better returns.

In our 2018 institutional investor survey, more than 50% of respondents cited performance concerns as a challenge to sustainable investing. This figure reduced to 48% in 2019 and stands at 45% in 2020.

Governments responsible for mitigating climate change

Institutional investors also tend to believe, as do the individual investors surveyed in our Global Investor Study, that national governments have the biggest role to play in mitigating climate change.

Andy Howard, Schroders Global Head of Sustainable Investments, said: “The growing regulatory focus on ensuring that asset managers meet sustainable investing definitions and criteria is to be welcomed. Yet it is also crucial that investors do not as a result feel overwhelmed by the growing amount of sustainability interpretations and demands.

“So it’s vital that asset managers work closely with clients to help them navigate the complex world of sustainable investments and support them in achieving their objectives.

“It is also crucial for us as asset managers to convince investors that investing sustainably should not be at the expense of delivering robust returns and meeting their long-term objectives.

“Positively, these findings deliver striking evidence that institutions globally are increasingly recognising that investing sustainably should now be a core component of their asset allocation process.”

- To find out more visit Schroders Sustainable Investment home page

About the Schroder Institutional Investor Study:

The global study was commissioned by Schroders for a fourth consecutive year to analyse institutional investors and their attitudes towards investment objectives, performance outlook and risks to their portfolio. The respondent pool represents a spectrum of institutions, including pension funds, insurance companies, sovereign wealth funds, endowments and foundations managing approximately $25.9 trillion in assets. The research was carried out via an extensive global survey during April 2020. The 650 institutional respondents were split as follows: 179 in North America, 248 in EMEA, 173 in Asia Pacific and 50 in Latin America. Respondents were sourced from 26 different countries.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.