UK economy grows just 0.1 per cent following Budget

The UK economy grew at a slower pace than expected in the month after the Budget, new figures show, raising fears that the Chancellor’s plans have contributed to economic stagnation.

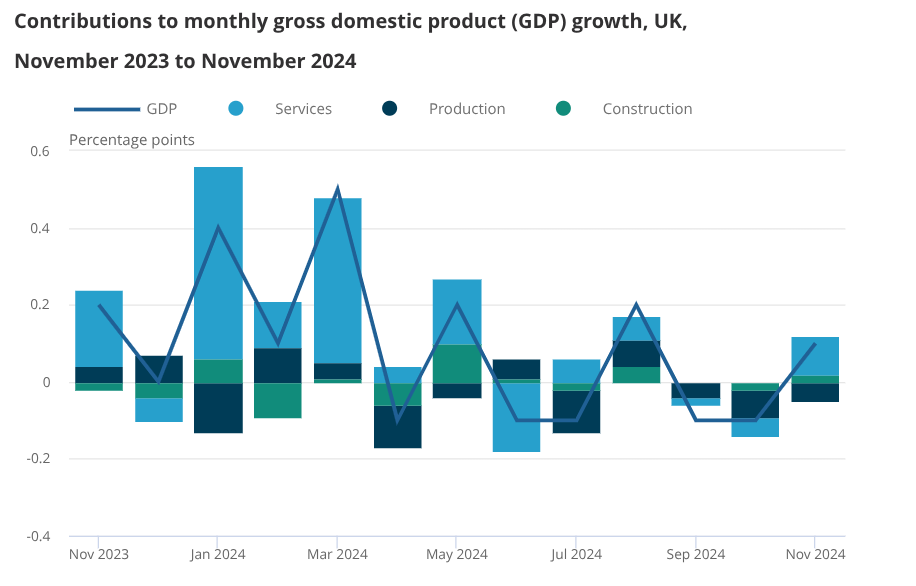

Gross domestic product (GDP) increased 0.1 per cent in November, according to the Office for National Statistics (ONS), which was slower than the 0.2 per cent expansion predicted by City experts.

The dominant services sector grew 0.1 per cent, led by healthcare and social work, while there was positive news in consumer-facing services, which grew 0.5 per cent having contracted in October. Construction output also rose 0.4 per cent.

This offset a 0.4 per cent decline in industrial production, with manufacturing, mining and water supply activities all dropping month-on-month.

Although weaker than expected, the figures confirm that the economy returned to expansion after two consecutive 0.1 per cent contractions in September and October.

But it still means the economy showed no growth in the three months to November, compared to the prior quarter.

“The economy continues to be broadly flat, having grown slightly in November following two small falls in the previous months,” Liz McKeown, director of economic statistics at the ONS said.

“Services grew a little, with wholesaling, pubs & restaurants and IT companies all doing well, partially offset by falls in accountancy and business rental & leasing.”

The figures will likely do little to quiet criticism of Chancellor Rachel Reeves, amid accusations that the government’s economic agenda has stymied growth.

Economic momentum has ground to a halt since Labour took office while business confidence has also fallen sharply, particularly in the wake of October’s Budget.

Including November’s figures, the UK economy has grown in only two of the last six months.

“Such an anaemic pace of growth is hardly worth celebrating,” Michael Brown, chief research strategist at Pepperstone said.

Business surveys from the end of last year point to a further slowdown in activity as firms brace for the impact of the national insurance hike.

“Right now, firms are struggling to deal with a raft of extra costs following the Budget. Investment levels are likely to remain low for the foreseeable future, as businesses try to balance their books,” Stuart Morrison, research manager at the British Chambers of Commerce said.

Simon Pittaway, senior economist at the Resolution Foundation, said the “paltry” growth in late 2024 reinforces the need for the government’s plans to “start bearing fruit”.

The consensus is for the UK economy to grow around 1.3 per cent in 2025, accelerating on the previous year thanks to the increase in government spending announced in the Budget.

Responding to the figures, Reeves said she was “determined to go further and faster to kickstart economic growth”.

“That means generating investment, driving reform and a relentless commitment to root out waste in public spending, and today I will be pressing regulators on what more they can do to deliver growth,” she said.

The figures come at a precarious point for the UK gilt market, which has suffered a bruising sell-off since the turn of the year driven in part by concerns about the UK’s lacklustre growth outlook.

The yield on benchmark 10-year gilt hit its highest level since the financial crisis last week, which could potentially force the Chancellor into further spending cuts later in the year.

However, pressure on gilts eased following the publication of December’s inflation report yesterday.

Inflation unexpectedly fell last month, dipping to 2.5 per cent. This contributed to a rebound in the gilt market, as traders anticipated further interest rate cuts.