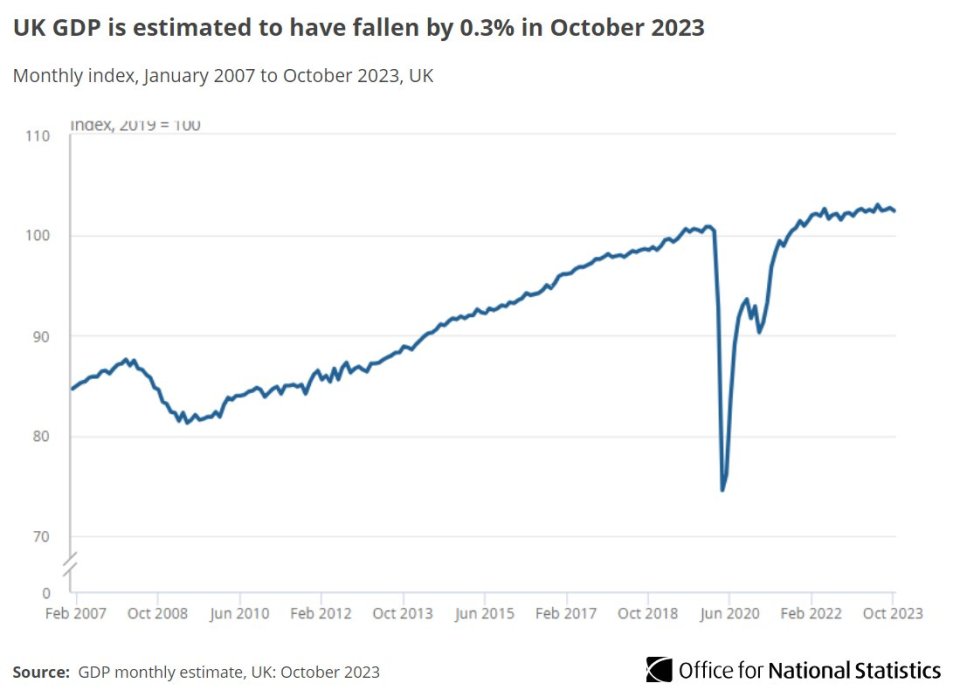

GDP falls sharply in October as UK economy recession fears re-ignite

GDP fell 0.3 per cent in the month of October, reigniting fears that a wave of interest rate hikes have strangled the UK economy.

The economy was flat over the entirety of the third quarter, according to the latest data from the Office for National Statistics.

But the economy shrank 0.3 per cent in the latest month on record.

Worryingly, services growth fell 0.2 per cent in October, too.

Analysts had expected a 0.1 per cent fall.

The figures set the scene for the Bank of England’s last call on interest rates of the year, to be announced Thursday.

The Bank has hit pause after a breakneck period in which the interest rate was hiked 14 times in a row.

Most analysts expect the Bank of England to hold rates this week, with members of the monetary policy committee in wait-and-see mode until the impact on the economy becomes clearer.

Some believe the Bank’s interest rate hikes have not filtered through into the wider economy yet, and the impacts need to be felt before any further action to strangle money supply.

In its Financial Stability Report published last week, Threadneedle Street’s Financial Policy Committee said higher interest rates continue to put some firms and households “under pressure,” but UK corporates in particular were expected to remain “broadly resilient to higher interest rates and weak growth”.

“In aggregate, UK corporates’ ability to service their debts has improved due to strong earnings growth,” the Financial Policy Committee said.

“But the full impact of higher financing costs has not yet passed through to all corporate borrowers and will be felt unevenly, with some smaller or highly leveraged UK firms likely to remain under pressure,” the report continued.

Yet the figures published today appear to show an economy that is already struggling from the higher cost of money.

As Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales, commented: “These figures suggest that the economy was unravelling even before the full force of previous interest rate rises fed through to households and businesses.

“October’s negative outturn puts the Prime Minister’s target to get the economy growing in jeopardy, with high inflation and borrowing costs likely to suppress economic activity in November and December.”

This view was backed up by Lindsay James, investment strategist at Quilter Investors, who said: “With GDP growth over the last rolling three month period also flat, economic conditions in the UK are clearly tough as we work through the winter months.”

“The Bank of England has done a good job not tipping the UK into recession to date, but interest rates are biting now and further contraction cannot be ruled out. It could be a while before things get better again,” she added.

Meanwhile, BusinessLDN has called for the Chancellor to “bring some Christmas cheer by pulling out all the stops to boost economic productivity and growth”, following today’s GDP numbers.

Muniya Barua, deputy chief executive of BusinessLND, said: “Agreeing a long-term capital funding deal for Transport for London would help to keep the capital moving while making childcare more affordable and accessible would help more people return to work, which is vital if Britain is to escape the low-growth trap.”

“Reversing the decision to scrap VAT-free shopping on goods for international visitors would also provide an immediate boost by encouraging more spending in our shops, pubs, restaurants and hotels during the festive period and beyond,” she added.