Gazprom exports to Europe down by a third as prices spike across the continent

Gazprom’s natural gas exports outside ex-Soviet Union countries fell 32.6 per cent year-on-year between January and February to 23.2bn cubic meters (bcm), according to the latest data published by the Kremlin-backed gas giant.

This is despite Gazprom’s output for the first two months of the year remaining broadly unchanged from the same period in 2021 at 84.9 bcm.

EU President Ursula von der Leyen recently warned that Gazprom gas supplies have dwindled to decade lows, with the bloc reliant on LNG imports – chiefly from the US – to meet its energy needs.

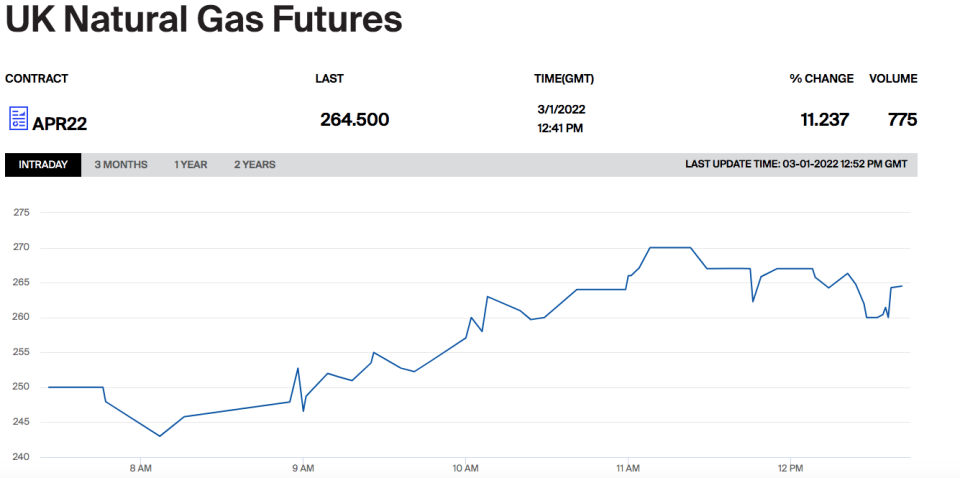

Fears of supply shortages following have caused UK and European prices to spike 11 per cent as Russia ramps up conflict in Ukraine following its invasion of the country.

The Western response to Russia’s invasion of Ukraine has been largely unified, powered by devastating financial measures.

It has excluded key Russian banks from the SWIFT payment systems and effectively frozen out its central bank.

However, it has stopped short of energy specific sanctions, although German chancellor Olaf Scholz has suspended the approval process for the Nord Stream 2 pipeline.

Meanwhile, Italian Prime Minister Mario Draghi has argued Italy can weather a complete breakdown in gas supplies from Russia in the short-term.

He said that government was ready to provide additional support to families and businesses amid market turbulence.

“Our forecast is that we will be able to absorb any peaks in demand from what we have in storage or other import sources,” Draghi said.

The country is seeking to reduce its reliance on Russia which supplies more than 40 per cent of the gas that it imports.

It is currently, working to increase supplies from other countries such as Algeria and Azerbaijan, as well as making greater use of liquified natural gas terminals.

Research published last month from think tank Bruegel suggests Europe would struggle to deal with more than a short term supply shortage to Russian gas.