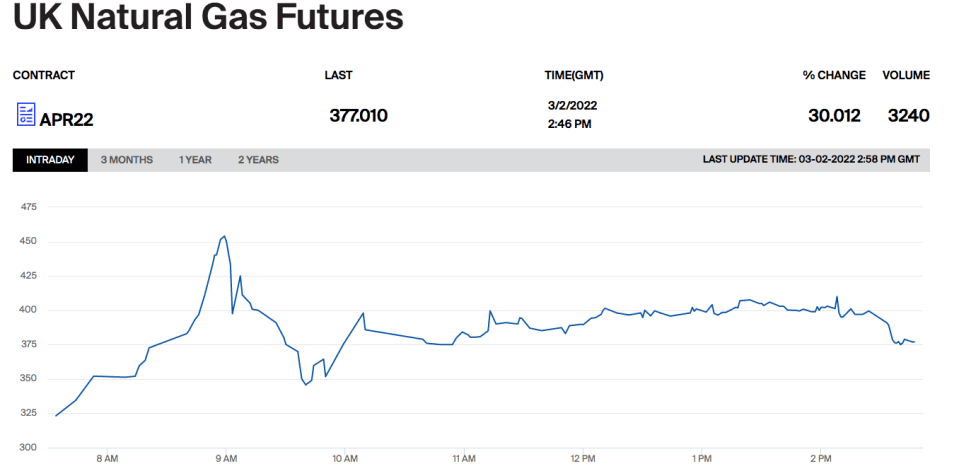

Gas prices spike as Russia ramps up invasion of Ukraine

Gas prices have spiked across the continent, with UK and European benchmarks rising 30 per cent amid festering fears of supply constraints as the West looks to isolate Russia from global markets.

The West has imposed devastating sanctions on the Russian financial system and while it has stopped short of energy specific measures – trade has already shown sign of disruption.

UK ports have banned Russian ships while BP has cancelled fuel loadings in the Black Sea.

Major firms such as BP, Shell, ExxonMobil and Equinor have also announced plans to ditch its stakes in the country’s energy sector.

Kremlin-backed gas giant Gazprom revealed yesterday it was still shipping gas to Europe via Ukraine in line with customers’ requests.

However it has announced no new auctions for February and March, and there are fears of conflict-driven disruption despite the Kremlin’s current intentions to continue trading oil and gas.

Gas exports from Gazprom were also down by a third in January and February, while it reportedly missed its full-year export targets for Europe and Turkey in 2021.

Meanwhile, EU Commission President Ursula von der Leyen announced earlier this month that Gazprom gas supplies are at decade lows within European storage.

The trading bloc has staved off blackouts over recent months with top-ups in liquefied natural gas (LNG) from the US, and has recently topped off supplies again courtesy of a flotilla of tankers arriving from across the Atlantic.

Ronald Smith, senior oil and gas analyst at BCS Global Markets told City A.M. there was a possibility Gazprom could provide more supplies this year, assuming trade continues with the West.

He said: “Exports are down, but production in January and February was very close to maximum capacity. This raises the question: where was the gas going? The only logical answer is that Gazprom was minimising storage withdrawals in Russia. If so, then it implies that Gazprom will exit winter with unusually full domestic storage, which means it will be able to redirect more gas than usual to Europe during the refill season, assuming Russian gas is attractively priced versus other options.”

Europe seeks to diversify energy mix to reduce reliance on Russia

The EU still relies on Russia for around 40 per cent of its natural gas – anything beyond a short term shock to supply could lead to difficulties in meeting rebounding consumer demand, as outlined earlier this year by European think tank Bruegel.

Ole Hansen, head of commodity strategy at Saxo Bank told City A.M. that Europe will need to diversify its energy sources, if it wants to both isolate Russia and meet the energy needs of its citizens.

He explained: “Europe at this point without gas from Russia will be a major challenge, but luckily spring and lower heating demand is just around the corner, and that could see the region scrape through but it still leaves a big question mark over next winter, and how to rebuild storage to a comfortable levels.”

He pointed to the speech from German Chancellor Scholz last weekend, where he opened up the possibility of increased LNG imports and capacity, restarting nuclear power plants, and boosting coal production again.

This was echoed today by economy minister Robert Habeck, who has suggested Germany could consider a slower exit from coal-powered energy should Russia stop gas deliveries to Europe in response to sanctions over its invasion of Ukraine.

Germany has also recently suspended the certification of the Nord Stream 2 gas pipeline, which would have doubled exports of Russian gas to Germany.

In a further blow to the pipeline’s prospects, Wintershall Dea AG’s management board has decided today not to advance or implement any additional gas and oil production projects in Russia and to write off its financing of Nord Stream 2 totalling around €1bn .

Commenting on Europe’s energy mix, Cornwall Insight’s Dr Craig Lowrey said: “In the longer term, the UK and other governments across Europe will need to weigh up their options for future gas supply. It is likely that many will look to fast-track their renewable projects and balance their reliance on imports from Russia and potentially other nations, to avoid unstable international geopolitical situations continuing to destabilise their energy prices.”