Gas prices soar as the Kremlin brings in sanctions against European Gazprom divisions

Gas prices on UK and European benchmarks have spiked again after the Kremlin has imposed sanctions on Gazprom units across the continent.

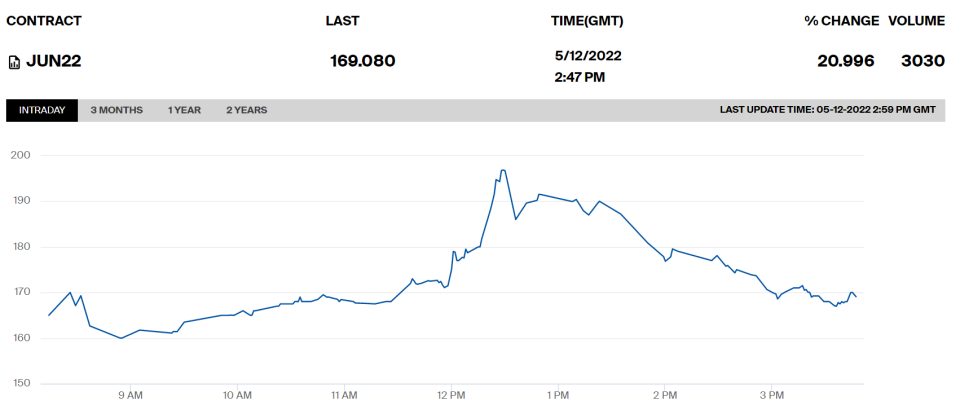

Dutch TTF Futures soared 11 per cent while the UK Natural Gas Futures spiralled 21 per cent, amid fears of supply shortages, with tensions between Moscow and the West continuing to escalate following Russia’s invasion of Ukraine.

Sanctioned entities include the owner of the Polish part of the Yamal pipeline that carries Russian gas to Europe, as well as the former German unit of the Russian gas producer Gazprom, whose subsidiaries service Europe’s gas consumption.

Both were included on a restrictions list, which prevents Russian businesses trading with them, or even fulfilling agreed obligations.

Gazprom is a Kremlin-backed oil and gas giant, but it has ditched multiple energy divisions following Western sanctions on Russia, as the Kremlin pulls away from Western markets.

The German government took control of the German unit last month after its parent company abandoned the supply arm, which is also home to Gazprom Energy, the UK-trading business platform.

The list was first proposed by Russian President Vladimir Putin earlier this month, and follows him signing into law demands for gas to be paid in roubles, and Gazprom cutting off supplies to Poland and Bulgaria.

Meanwhile, Russian Foreign Minister Sergei Lavrov warned earlier this week it has enough buyers for its energy resources outside of Western countries.

He said: “Let the West pay more than it used to pay to the Russian Federation, and let it explain to its population why they should become poorer.”

The implications for gas supplies to Europe, which buys more than a third of its gas from Russia, were not immediately clear.

Eastbound gas flows continued via the Yamal-Europe pipeline from Germany to Poland, data from pipeline operator Gascade showed.

Gazprom supplies much of its gas to Europe via the Yamal-Europe pipeline, and its various activities across and outside Europe are essential for the European gas market and its supply to industry and households.

Separately, Shell has continued its plans to fully exit from Russia – with the country’s second largest oil producer Lukoil set to buy its Russian retail and lubricants businesses.

The proposed deal includes 411 retail stations, mainly located in the Central and Northwestern regions of Russia, and the Torzhok lubricants blending plant.

Shell has written down $3.9bn post-tax after it pulled out of its Russian operations, including the large Gazprom-operated Sakhalin 2 LNG plant, in which it holds a 27.5 per cent stake.