Gas prices soar amid supply shortage fears as Russia-Ukraine tensions escalate

Analysts warned last night that escalating tensions over Russia’s seemingly inevitable invasion of Ukraine would hit European gas supplies.

A note from investment bankers Goldman Sachs (Goldman) suggested that delays to the approval of Russia’s new pipeline into Europe, Nord Stream 2, would see gas prices spike.

Goldman argued failing to certify the pipeline could push prices further up, putting pressure on energy companies as well as contributing once again to a worldwide inflationary push.

The bank’s analysts said: “Should tensions between Russia and the Ukraine escalate, the initial uncertainty around its impact on gas flows would likely lead the market to once again add a significant risk premium to European gas prices.”

The freshly constructed pipeline awaits approval from Germany’s regulators, following recent delays due to concerns over its governance.

German chancellor Olaf Scholz has revealed he could refuse to approve the pipeline if Russia invades Ukraine, with the Kremlin positioning over 100,000 troops near the country’s borders over the past month.

Such a dramatic measure would be costly for Germany, which was expecting to double its gas flows from Russia with the new pipeline.

It would also deepen Europe’s energy crisis, amid current supply shortages and eastward gas flows away from the continent on key pipelines such as Yamal-Europe.

It would also antagonise Moscow, with the EU dependent on Russia for around 40 per cent of its natural gas supplies.

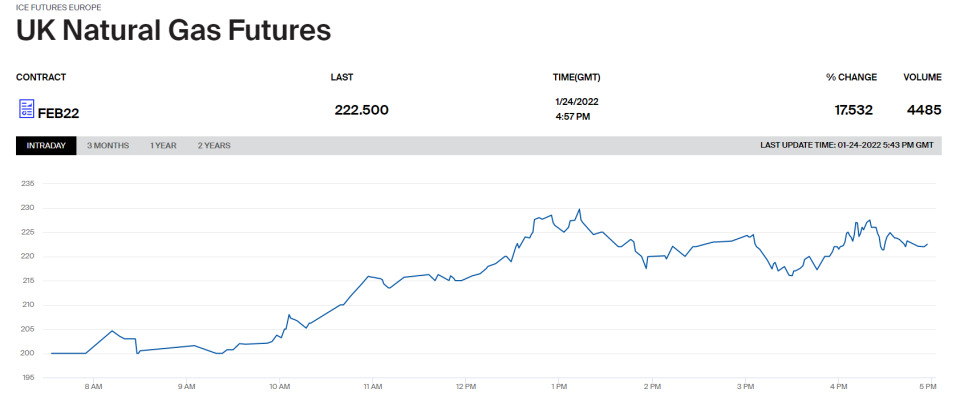

Both major gas benchmarks have already responded to escalating fears of gas shortages, with UK Natural Gas futures and Dutch TTF futures yesterday booming 18.3 per cent and 17.7 per cent respectively.

Nathan Piper, head of oil and gas research at Investec told City A.M. that potential conflict could shorten Europe’s already diminishing gas supplies this winter.

He said: “Any further increase in tensions is likely to lead to higher European and UK gas prices. The implementation of sanctions could add complications for the purchase of oil by refineries from the world’s third largest oil producer.”

While OANDA’s senior analyst Craig Erlam considered limitations on gas sales to be a “last resort” he recognised the market had no choice but to “price in the additional risk”.

The analyst also suggested Nord Stream 2 was likely to become a bargaining tool.

He explained: “The other thing to consider is how much Europe can rely on Russia if stocks are drawn upon quickly in the coming months. This isn’t just about Ukraine, the Nord Stream 2 pipeline is also on the table and will be used as a bargaining tool if it gets to that.”

The UK has ordered some of its embassy staff to leave Ukraine, and while the West has stopped short of committing troops to the country, Prime Minister Boris Johnson has warned Russian premier Vladimir Putin that any invasion would be “painful, violent and bloody.”

Ron Smith, senior oil and gas analyst at BCS Global Markets, has encouraged the EU to boost its own gas production and increase its storage facilities, with current supplies only reaching 43 per cent of overall capacity.

He said: “Europe cannot fully supply itself or return to production levels of 10 or 20 years ago, but could be producing more than it is today in the right investment environment. They should increase storage facilities, including, perhaps, strategic gas storage with state backing much on the model of strategic petroleum reserves.”