Gas prices rise in UK and Europe on surging summer demand for air conditioning

Soaring demand for air conditioning across Europe with warmer weather marking the beginning of summer has contributed to the latest spike in gas price.

Alex Smith, equity analyst for oil and gas at Investec, told City A.M. that the combination of supply uncertainties and rising energy consumption across the continent was responsible for the latest uptick in prices on Dutch and UK benchmarks.

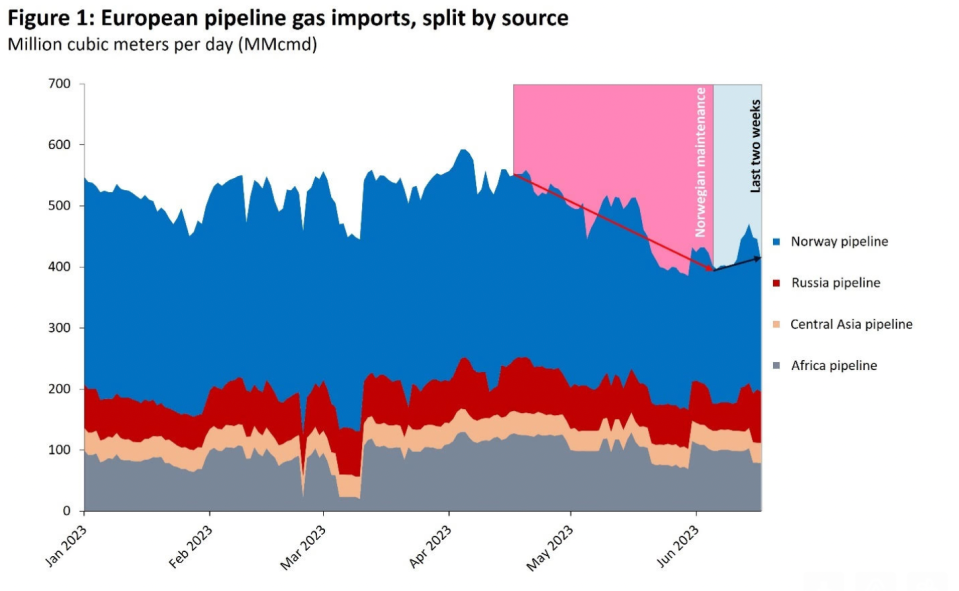

He said that despite storage at high levels, there are fears around supply levels, following outages in Norway and the North Sea and maintenance work at Turkstream last week leading to a hit to supply.

“This has been combined with increased demand for air conditioning across Europe given the warmer weather. The combined factors have led to a steady rise in pricing the past couple of weeks,” Smith said.

Rystad Energy also noted the effect of hot weather on demand and highlighted that weather forecasts for July are also above normal in Northern Europe, with hot weather expected throughout the month.

It said the “main driver” in prices was an unexpected three-week extension in maintenance at Norway’s Nyhamna gas processing plant and at feedgas fields Orman Lange and Aasta Hansteen – which will not be back up to full capacity until 15 July.

Gas is currently trading at 96p per therm on the UK Natural Gas Futures market, having started the month at 54p and peaked at over £1 per therm earlier this week.

European prices have also risen sharply, nearly doubling from €23 per megawatt hour to nearly €39 per megawatt hour, having hit €41 last week.

While this is way below last year’s record peaks, it is also a rebound from the easing prices amid reduced demand over winter following the EU successful scramble for supplies after a Russian squeeze on pipelines.

Winter gas challenges loom for Europe

Where experts differed was in the medium-term outlook for supplies, heading into winter.

Rystad recognised prices remain in “a state of flux” with the market still looking to “rebalance itself.”

However, it remained bullish about Europe’s gas supplies, noting that storage levels are currently around 74 per cent, compared to 54 per cent this time last year.

The bloc has topped up supplies with LNG imports, with demand set to soar over the current decade.

“Fundamentals show that pipeline and LNG supply remains strong despite slight hiccups in Norwegian production and flows, as illustrated by above-average storage build-ups. Barring further supply shocks, or a sudden increase in demand, TTF prices should be less volatile once maintenance on Norwegian pipelines ends,” it concluded.

However, Smith said while demand had eased earlier this year – markets are likely to remain “incredibly tight.”

This would remain the case until the bloc found a long-term alternative to Kremlin-backed supplies amid Western sanctions, following Russia’s invasion of Ukraine last year.

He said: “Long term questions are still on winter pricing, and with supply tight today the marginal levels of gas are not being added to storage. Winter pricing forward contracts have gone up in the last few weeks accordingly given market nervousness on security of supply and global competition for gas.

“The simple answer is looking at the long term, Europe has still yet to find a solution to replacing Russian gas and therefore there is still structural imbalances over future energy security across Europe.”