Gas prices deflate to 16-month low with more supplies shipped to Europe

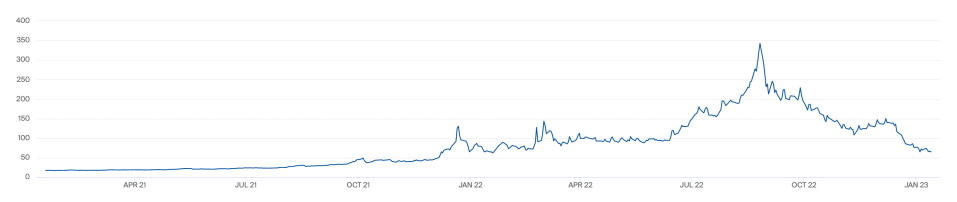

Natural gas prices in Europe dropped to a 16-month low yesterday, with full stockpiles in China forcing buyers to send more supplies to the continent.

The Dutch TTF benchmark – the key European future market for trading gas – fell sixteen percent on Monday trading at €64.80 per megawatt hour (MWh).

This is well below historic peaks last year when prices climbed to €342.87 per MWh, but it remains above pre-crisis levels with gas prices at €17.11 per MWh this time two years ago.

Chinese importers are trying to divert February and March shipments to Europe, while mild weather has kept liquefied natural gas storage topped up above 80 per cent.

UK gas prices also nosedived, falling 17 per cent in the evening to trade at £1.62 per therm – the lowest it has been in over a year.

This is well below last summer’s record of £8.75 per therm in August, but is significantly higher than the norm of 45-50p per therm prior to the energy crisis.

Prices to remain above normal levels until 2030

Energy prices are still expected to remain above pre-crisis levels through the decade – with Cornwall Insight’s latest figures on power prices reflecting the new reality.

Its latest data forecasts a decline in prices up to 2030 as Europe secures alternative energy supplies to compensate for reduced gas flows from Russia.

Its latest outlook predicts price drops of over £50 per MWh compared to its forecasts from the third quarter of 2022, with renewables driving down prices as they become a greater part of the energy mix.

Despite the drop, Cornwall Insight’s figures remain significantly above pre-pandemic levels, with little promise that power prices will resemble so-called “normal” levels for some time.

The energy analyst expects power prices are likely to have an impact on end users, with businesses and households seeing comparatively high bills for the next decade.

Tom Edwards, senior modeller at Cornwall Insight, said: “The rational long-term route away from instability, high cost and high bills, is to increase renewable energy.”

“Power from sources such as offshore wind deliver relatively low marginal costs and increased security; however, reaching renewables targets will require a steady stream of investment from both government and business, which is by no means guaranteed. It is important that the UK and, indeed, the rest of Europe stay on track with their low-carbon ambitions,” Edwards said.