Gambling sponsors back on the up in sport despite continued threat of a ban, study finds

Gambling sponsorship in English sport is back on the rise despite the threat of a potential ban, according to a new study.

The number of betting companies with front-of-shirt sponsorship deals at leading clubs appeared to be in terminal decline just a year ago, having plummeted 48 per cent from 2019 to 2021.

Premier League football clubs have considered adopting a voluntary ban on bookmakers taking the coveted front-of-shirt slot in a bid to head off possible legislation.

But the sector has bounced back over the last 12 months and gambling is now the second most prevalent industry in a study of 226 men’s and women’s football, cricket, rugby union and rugby league teams from England and Wales.

The findings are drawn from a report due to be published today by sponsorship intelligence company Caytoo.

“It’s a notable return to favour for gambling after its share of sponsorships nearly halved from 2019 to 2021,” said Alex Burmaster, head of research and analysis at Caytoo.

“However, this year, deals in rugby and cricket have resulted in a mini comeback which will surprise many as publicity on gambling sponsorship centres on football.

“So, the big questions are: will the Premier League voluntary ban happen and, if so, will other divisions or sports such as rugby and cricket follow suit?”

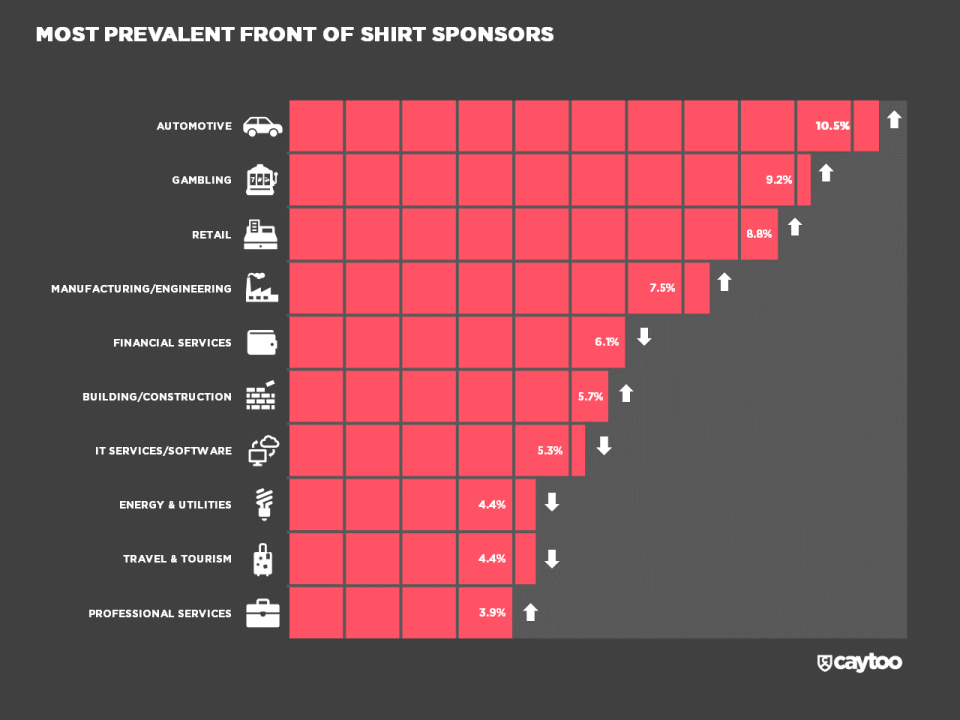

Sponsors from the car industry are the most prevalent across all four sports, taking 10.5 per cent of deals, but gambling companies are top of the pile in football.

Eight of the Premier League’s 20 teams have betting firms as their front-of-shirt sponsor, including West Ham United and Everton.

In another indication of the industry’s reach, Dafabet has the joint-most deals of any sponsor across the leading football, cricket and rugby teams. Stake is among a clutch with three.

Minsters are reported to have softened their stance on gambling brands appearing on football shirts, switching from favouring a ban to seeking a voluntary agreement to phase them out.

Under the agreement that the Premier League asked its 20 clubs to consider last month, only front-of-shirt deals would be banned.

Clubs would still be permitted to advertise betting firms on their sleeves and around their stadiums.

More leeway is expected to be afforded to clubs lower down the football pyramid whose financial struggles could be severely worsened by a ban.

Some groups have called for a ban, such as Football Supporters Against Gambling Ads and charity Gambling With Lives, through its campaign the Big Step.

However, any exodus may see bookmakers replaced by cryptocurrency-related firms, which have also been criticised for encouraging financial speculation.

Across football, cricket and both codes of rugby, manufacturing/engineering was the biggest growth sector for sponsorship, followed by retail.

Financial services saw the biggest drop, falling from second most prevalent to fifth, while alcohol brands’ share of the market shrunk further to just one per cent.

“The covid pandemic meant digitally-led firms dominated last year’s fastest-growers but this year, with the exception of online car retail, has seen more traditional sectors leading the charge,” said Burmaster.

“It’s a reminder that chasing the next new thing isn’t always the best route when selling sponsorship. We frequently get requests to help find a fintech, crypto or online food delivery sponsor but we’re never asked to find a manufacturing or engineering one.”