Future for Sporting Index revealed

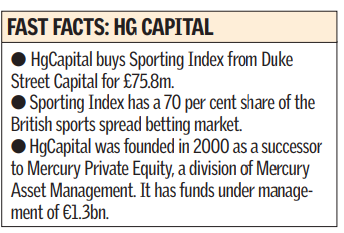

Private equity firm HgCapital’s growth plans for new charge Sporting Index include bolt-on acquisitions and gaining a foothold in key cities abroad.

HgCapital head of leisure investments Ben Hewetson said: “We will be looking at acquisitions from day one. The (British) spread betting business continues to improve its performance but one of the most exciting parts will be going into new markets.”

Hewetson refused to identify target countries but said international expansion was a priority. While owned by Duke Street Capital, the management team did not have a remit to explore new markets.

Yesterday HgCapital confirmed that it had agreed to acquire the business from Duke Street in a £75.8m cash deal. Sporting Index’s management team remain aboard and have retained a “meaningful stake”.

Sporting Index has a 70 per cent share of the British sports spread betting market and has significant scope to grow its 45,000-strong customer base with new product launches. Hewetson said that Sporting Index has a loyal customer base — the business was built on telephone betting customers.

Elsewhere, internet gaming firm Empire Online issued a trading statement yesterday warning its net profit for 2005 would be 10 per cent below the market estimate, sending its shares as much as 13 per cent lower.

Empire Online has been knocked by PartyGaming’s decision to shift players on its PartyPoker.com site to a separate operating platform. Broker Numis is now expecting $54.9m (£31.4m), 43 per cent lower than its earlier forecasts.