Future completes TI Media takeover as Covid-19 hits magazine sales

Publishing group Future today said it had completed its takeover of rival TI Media but warned of job cuts as the coronavirus outbreak takes its toll on magazine sales.

The competition watchdog last week cleared Future’s £140m offer for TI Media — which owns titles such as Country Life and Marie Claire UK — subject to the sale of three closely competing titles.

Future today said it has agreed the sale of World Soccer and Amateur Photographer to Kelsey Media and Trusted Reviews to Incisive Media.

Combined with TI Media’s sale of digital marketing agency Collective Europe earlier this year, the transactions were valued at £1.4m.

Future, which publishes titles including Four Four Two and Tech Radar, said its digital revenue was proving resilient during the coronavirus outbreak, with a decline in advertising offset by ecommerce and audience growth.

Product review site Tom’s Guide secured its best month ever in March with a record 28m sessions, while Live Science pulled in 100m sessions over the month.

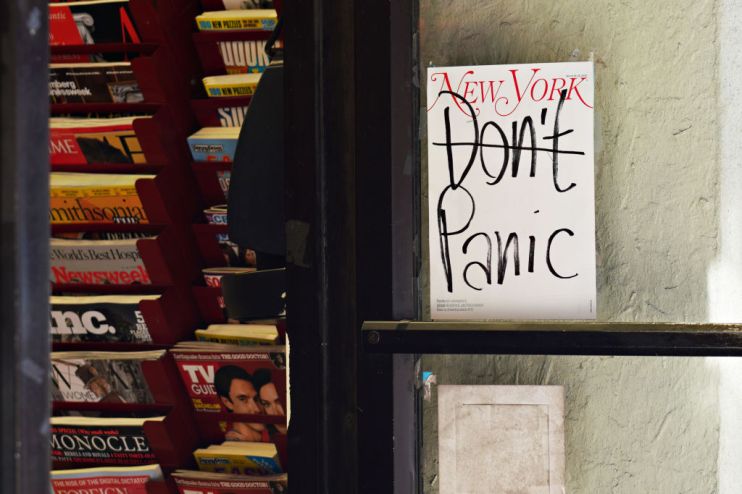

But Future warned of a “significant” reduction in print sales due to high street store closures, while its events business has been hit by postponements and cancellations.

The firm said it had taken action to cut costs including reducing supply of print magazines, accelerating closures of fringe titles and furloughing some staff. In addition, senior management and board members have taken a 20 per cent pay cut.

But Future said TI Media was a less diversified business and therefore more exposed to the impact of the pandemic, with UK newsstand sales down roughly 30 per cent since lockdown measures were introduced in March.

As a result, the publisher warned some staff would be furloughed and some jobs cut, with tiered salary reductions for all remaining employees.

Following the acquisition Future’s net debt now stands at £93m, but the company said it has signed a new £30m revolving credit facility to bolster its working capital.

As previously announced, TI Media finance director Rachel Addison will take over as chief financial officer. She replaces Penny Ladkin-Brown, who will step down from the board to take the role of chief strategy officer.