Further tax rises ‘a good bet’ after Chancellor’s borrowing blow

Further tax rises or spending cuts look increasingly likely after the latest borrowing figures, but there were a few silver linings for the Chancellor.

Figures from the Office for National Statistics (ONS) showed that government borrowing hit £17.8bn in December, over £10bn more than the year before and well ahead of City forecasts.

Borrowing in the month of December was at its third highest level since monthly records began back in 1997, excluding only the pandemic and 2009.

“This overshoot in borrowing compared with expectations was due to a surge in central government expenditure,” Philip Shaw, chief economist at Investec said.

The ONS recorded a one-off payment worth £1.7bn to repurchase military accommodation, which forced up the Treasury’s monthly investment bill.

There was also higher spending to fund public sector pay rises and inflation-linked benefits.

Perhaps the most important increase in expenditure was the government’s interest bill, with monthly debt servicing costs climbing to £8.3bn, nearly £4bn higher than last year.

This was the third-highest figure since records began back in 1997 and excludes the impact of the recent bout of instability in the gilt market.

Although gilt yields have recovered most of the ground lost earlier in January, borrowing costs remain well ahead of where they were back in October.

Borrowing costs the key

Economists agreed that higher borrowing costs alone would likely force Rachel Reeves to announce further tax rises or spending cuts later to stay on the right side of her fiscal rules.

“Higher debt interest payments alone will make it a close call as to whether the Chancellor’s fiscal rules are met, even before considering other forecast revisions,” Matt Swannell, chief economic adviser to the EY Item Club, said.

Elliott Jordan-Doak, senior UK economist at Pantheon Macroeconomics, said the Chancellor was already under pressure to clarify how she would meet the fiscal rules.

“We expect the Government to outline spending reductions—backloaded towards the end of the forecast year—at the next fiscal event in March. Further tax increases at the next Budget in October, is also a good bet,” he said.

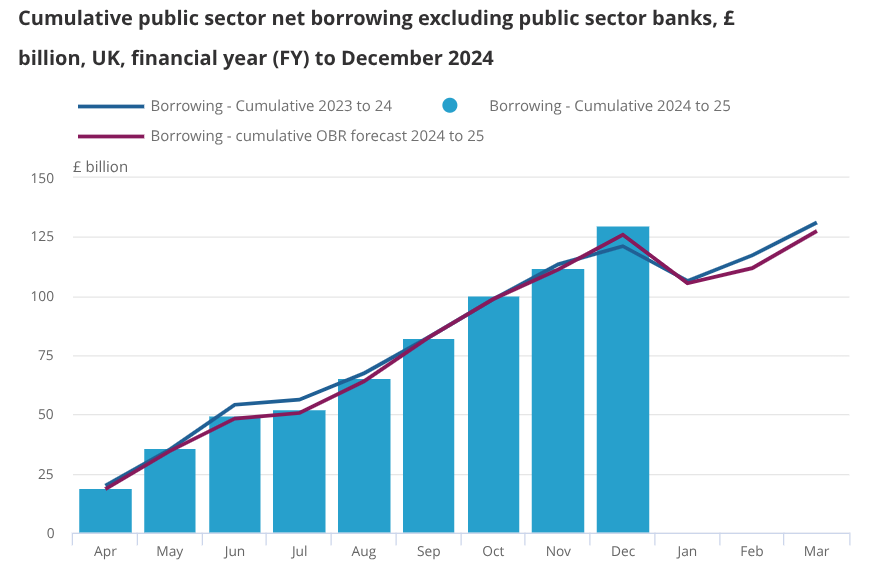

Factoring in December’s figures, government borrowing has totalled £129.9bn in the first nine months of the year, exceeding the OBR’s forecasts for the same period by £4.1bn.

This put borrowing in the year-to-date as at its second highest level since records began in 1993.

Silver linings for Chancellor?

However, a few analysts noted that there were some silver linings for the Chancellor. In particular, economists noted that December’s tax receipts came in slightly ahead of expectations despite the UK’s recent weak growth.

“The UK’s recent run of poor economic data hasn’t yet fed through into the public finances,” Cara Pacitti, Senior Economist at the Resolution Foundation, said.

Additionally, while total government borrowing has come in ahead of expectations in the fiscal year, central government expenditure has actually come in below the OBR’s estimates so far.

Total borrowing has increased – despite resilient tax receipts and better than expected government expenditure – because of other borrowing elsewhere in the public sector.

As the OBR said in its commentary on the figures: “This upside surprise against profile reflects higher-than-expected borrowing by local authorities and public corporations, with central government borrowing – the largest sector – slightly below profile”.

Pacitti noted that local government borrowing figures are “very volatile and prone to revision”. Future updates from the ONS might wipe away some of the overshoot.

Still, there’s no doubt that the Chancellor is in a tough spot, particularly given the signs that the economy has slowed since the Budget.

What really matters for the UK’s fiscal position is the longer term growth outlook, and the recent news has not been good.