Fuel be sorry: Record petrol prices could hurt retail sector warn experts

Petrol prices soared to record highs last week, powered by historic rallies in the oil market following Russia’s invasion of Ukraine and escalating fears of supply disruption.

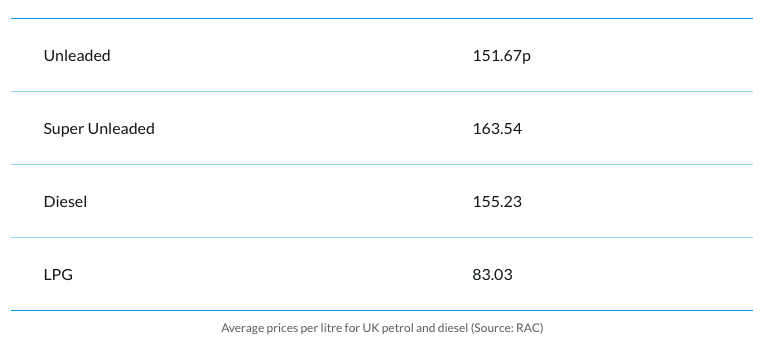

This is now starting to be felt at UK forecourts – with prices rising to £1.55 per litre for diesel and £1.52 for unleaded – meaning it could cost over £85 to fill up a 55-litre family car.

However, the British Retail Consortium (BRC)’s Andrew Opie, has reassured consumers that the UK gets its petrol and diesel “from a variety of sources, including domestic production,” with no shortages in sight.

Eye-watering prices at the pumps have intensified the country’s cost of living crisis, with households already facing a hike in energy bills, record levels of inflation in grocery items, and a painful increase in National Insurance rates.

Alongside raising the pressure on essential items, it could also lead to an increase in the price of consumer goods, with the market seemingly transitoning from in-store retail to online purchasing at a rapid rate.

Soaring prices may result in shoppers being put off from venturing out to retail destinations – potentially spelling bad news for the recovery of bricks-and-mortar.

The pandemic has catalysed an e-commerce boom, with increasingly more shoppers making online purchases than two years ago.

“We believe the price of petrol is unlikely to dampen the trend toward online shopping, given the impetus towards e-commerce. In fact, it could give consumers another reason not to drive to stores,” Dan Myers, UK and Ireland managing director of XPO Logistics, tells City A.M.

However, retail voices warn e-commerce vendors will be unable to dodge rising fuel prices for long, even if they do pick up more customers.

“Fuel is a significant cost component of the overall distribution service we provide,” Myers says.

He explains: “E-commerce platforms and their retail partners could choose to recover the added fuel cost through pricing or delivery fees or simply absorb the cost — that will depend on each company’s strategy.”

Retailers may look to get creative in order to suppress costs, including ensuring packages are grouped together as much as possible.

Nevertheless, there are “limits to the costs that retailers can absorb,” suggests BRC chief Helen Dickinson.

She adds: “Retailers are going to great lengths to mitigate against these price rises and support their customers.”

Meanwhile, online retailers and food delivery services could soon face a space crunch thanks to the rapid roll-out of firms in London.

Real estate group CBRE has even warned London will run out of available industrial space within five months, should the current take-up rate continue.

These factors all raise questions over whether online retail can sustain momentum in a post-lockdown era, especially against skyrocketing inflation and continued conflict in Ukraine.