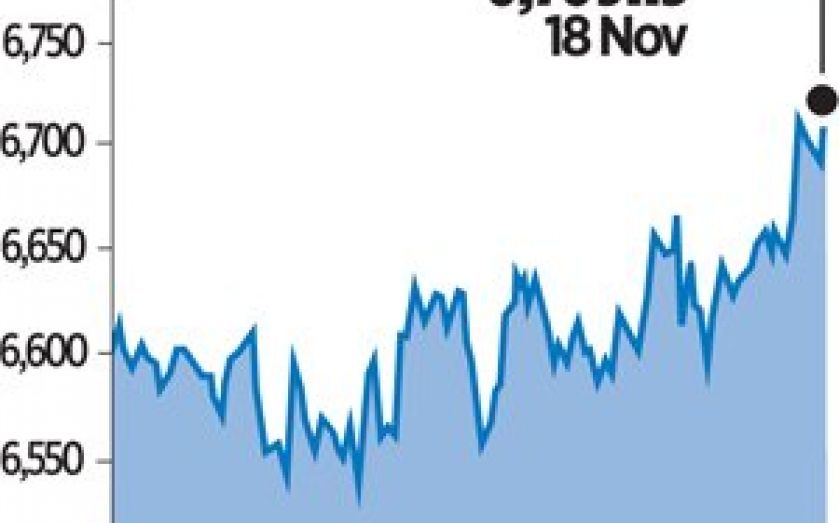

FTSE rises as energy firms expect Opec to cut production – London Report

BRITAIN’S top share index yesterday climbed to a seven-week high, helped by better-than-expected German investor sentiment data and a rally in energy stocks on speculation that oil producing countries may agree to cut output.

The blue chip FTSE 100 index closed up 0.6 per cent at 6,709.13 points after rising as high as 6,714.12, the highest level since late September. The index has surged more than 10 per cent since a low in mid-October.

The UK oil and gas index rose 1.1 percent, the top sectoral gainer, with oil companies such as Royal Dutch Shell A, up 1.38 per cent at 2,236p, Tullow Oil, rising 3.55 per cent to 475p, and BP gaining 1.19 per cent to 437.60p, mainly on expectations that the Organisation of Oil Producing Countries (Opec) could agree on an output cut at next week’s meeting in Vienna to prop up tumbling prices.

Bullish updates from some firms also supported prices. British Land rose 1.63 per cent to 749p after posting an 11.8 per cent rise in half-year net asset value, reaping the benefits of London’s booming property market.