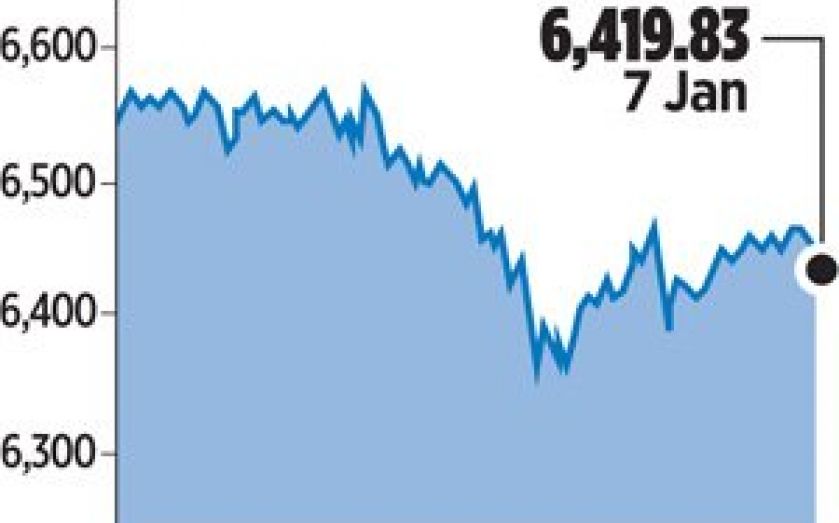

FTSE rebounds on expectations of European QE – London Report

Britain’s top equity index gained nearly one per cent yesterday, rebounding from a three-week low as Eurozone consumer price data raised expectations of new stimulus from the European Central Bank.

The blue chip FTSE 100 index, which had fallen in the last three sessions and hit its lowest since mid-December on Tuesday, finished 53.32 points, or 0.83 per cent, higher at 6,419.83.

Among sectoral gainers, energy stocks topped the list. The UK Oil and Gas index rose 1.1 per cent after recent sharp declines, mirroring some gains in battered crude oil prices.

Retail stocks remained volatile. Sainsbury’s rose more than four per cent in early trading after reporting better-than-expected results in the Christmas quarter.

But its shares closed down 2.13 per cent at 229.60p on concern it might lose more market share to discounters and could suffer in an intensifying price war.

“Sainsbury’s numbers were better than expected, but I am not a buyer of the stock for now, as top line guidance remains unchanged,” said Securequity sales trader Jawaid Afsar.

Rival retailer Tesco, which posts an update tomorrow, gained 1.8 per cent to 182p and Marks & Spencer rose 1.9 per cent to close at 463.20p.

WM Morrison shares, however, fell 1.3 percent to 171.40p.

Among other retailers, shares in the online fashion company Boohoo.com, which is on the secondary Aim index, slumped 42.5 per cent to 22p after cutting its profit outlook.

Aggreko, which fell 12 per cent in 2014, rose three per cent to 1,481p. The world’s biggest temporary power provider raised its 2014 trading profit expectations following a debt settlement and after reporting new and extended contracts in South America and West Africa.

Persimmon shares added 0.85 per cent to 1,541p following the home builder’s report that it sold 17 per cent more homes at higher prices in 2014.

Majestic Wine was also under pressure after the 210-strong wine warehouse business said Christmas trading was “particularly challenging” as it had to increase promotions in its stores and online to attract customers.

Like-for-like sales edged up 1.1 per cent in the 10 weeks to 5 January, but it had to cut margins to shift stock during the period.

Shares were 17 per cent lower at 330p.