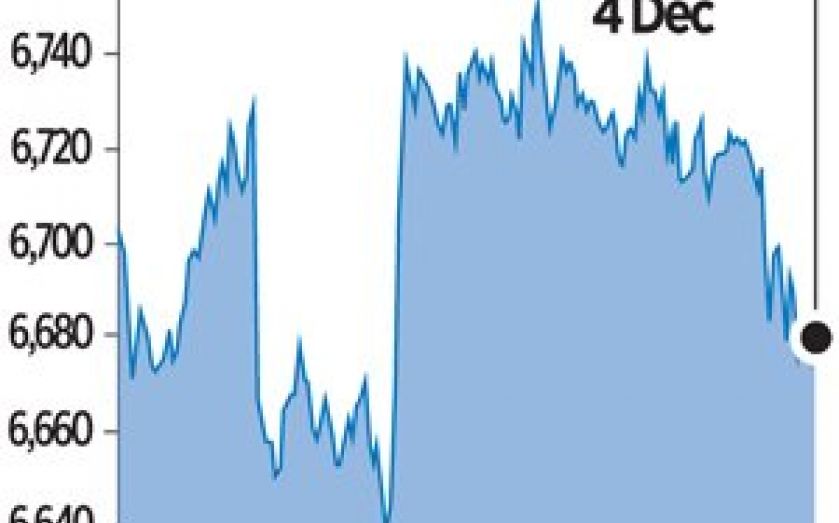

FTSE drops over Draghi’s lack of stimulus news – London Report

BRITAIN’S top equity index fell yesterday largely due to a drop in commodity stocks and disappointment at a lack of concrete, new economic stimulus measures from the European Central Bank (ECB).

The blue chip FTSE 100 index closed down by 0.6 per cent, or 37.26 points, at 6,679.37 points.

The ECB slashed its growth and inflation forecasts but stuck to its line that it will assess the need for fresh action only in early 2015, despite pressure to do more to prevent the bloc going into reverse, including a public call from Washington to act.

A pullback in mining and oil shares further weighed on the FTSE.

Miner Anglo American fell 2.8 per cent to 1,283.50p, while Rio Tinto declined 2.6 per cent to 2,933.50p after price target cuts from Bank of America Merrill Lynch.

BHP Billiton also fell, down 1.22 per cent at 1,500p.

A new fall in the price of oil also impacted stocks such as BP, down 2.3 per cent to 426.90p, and Tullow Oil, which retreated three per cent to 408.90p. Royal Dutch Shell B fell 1.29 per cent to 2,150p.

But shares of budget carrier EasyJet climbed 2.9 per cent to 1,716p as the company logged 3.1 per cent growth in passengers in November. Load factor, or the percentage of seats filled with passengers, rose to 89.5 per cent from 89 per cent.

EasyJet shares were among the winners in Wednesday’s session, as the government said it would exempt children from taxes on economy-class flights.

Shares in British Airways and Iberia owner International Consolidated Airlines Group also climbed, by 0.09 per cent to 466.50p.

Shares of Tui Travel picked up 3.64 per cent to 444.30p as the package holiday provider posted an 11 per cent rise in fiscal 2014, underlying operating profit on a constant currency basis, surpassing its recently raised forecast.

Unilever gained 0.15 per cent to 2,680p after the consumer-products maker decided to turn its spreads division — which includes the Bertolli margarine brand — into a stand-alone company, as the unit weighs on the rest of business.

Meanwhile, in Europe, the FTSEurofirst 300 index of top European shares ended 1.4 per cent lower, at 1,380.77 points, its sharpest one-day drop in seven weeks.