FTSE dragged by Smith & Nephew – London Report

BRITAIN’S blue chip share index gave up early gains for a third straight session yesterday and dropped back from record highs as prospects for a takeover of Smith & Nephew dimmed and its shares slumped.

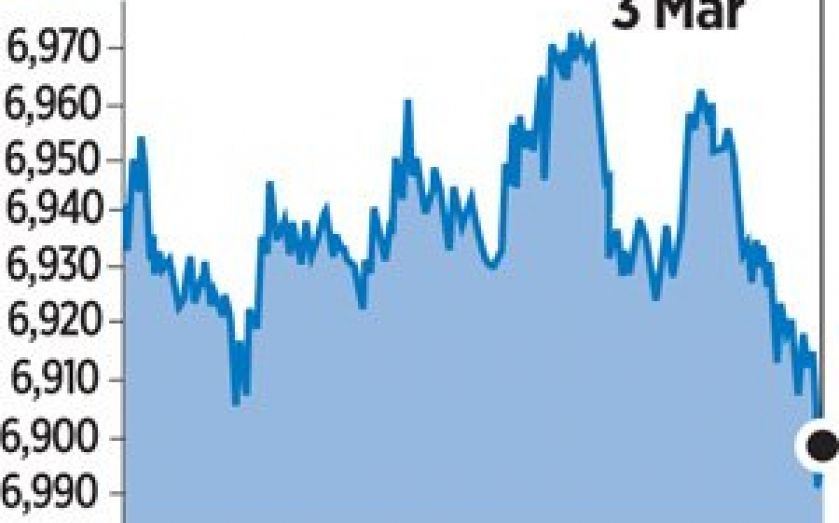

The FTSE 100 index was down 51.51 points, or 0.7 per cent, at 6,889.13 points at the close, not far from a record high of 6,974.26 points set in the previous session

Smith and Nephew fell 5.7 per cent to 1,144p after US firm Stryker announced a $2bn share buyback programme, making it increasingly unlikely it would consider a bid for the UK medical equipment firm, traders said.

The slump saw the shares hit their lowest level since late December. The stock leapt nearly eight per cent then on media reports that a bid for Smith & Nephew would be made.

Glencore and Barclays also weighed on the market after earnings releases.

Barclays fell 3.2 per cent after saying it had set aside an extra £750m for potential fines arising from allegations of manipulation in the foreign exchange market.

Glencore fell 3.1 per cent after the mining company and commodity trader took an impairment charge of $1.1bn on lower commodity prices.