FTSE climbs in late rally as BA owner IAG soars – London Report

BRITAIN’S top share index rebounded late yesterday, helped by a surge in British Airways owner International Airlines Group (IAG) due to strong traffic figures and by rallies in broadcaster ITV and bank Standard Chartered.

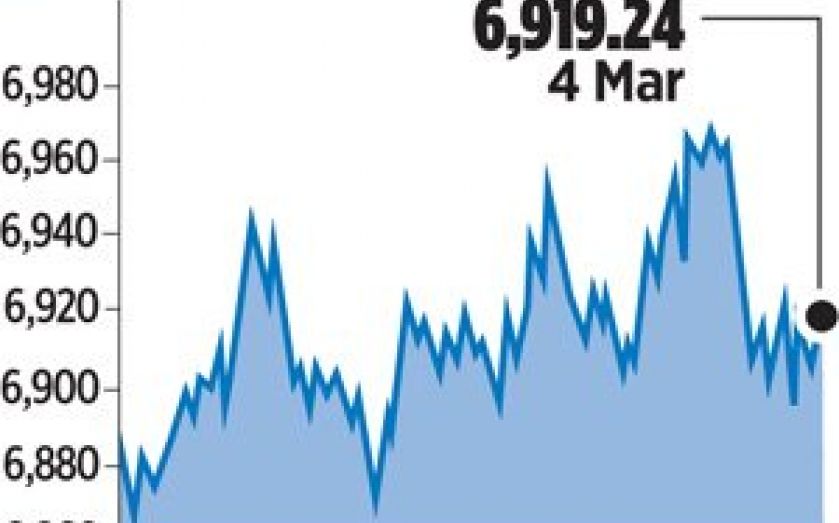

The FTSE 100 snapped a three-day losing streak to end 0.4 per cent higher at 6,919.24 points after trading as low as 6,862.87 points in the early part of the session.

The FTSE has rallied more than 10 per cent since mid-January, fuelled by anticipation of the European Central Bank’s stimulus programme, details of which are to be announced today.

IAG surged in late trade to close 2.4 per cent higher at 569.50p after reporting a 5.5 per cent increase in group traffic in February.

EasyJet finished the day 2.2 per cent up at 1,738p.

The best performer on the index was ITV, however. It climbed 5.7 per cent to 234.50p after the company said it planned to return £250m to shareholders through a special dividend after posting a better-than-expected 2014 profit.

Standard Chartered added 5.1 per cent to 1,040p as investors took heart from the bank’s planned restructuring programme despite a 25 per cent slump in profits.

Barclays, up 1.73 per cent to 258.70p, rebounded from heavy falls on Tuesday, although UBS cut their price target on the stock from 305p to 295p.

Miner Fresnillo fell to the bottom of the FTSE 100, down 4.2 per cent at 758p, after reporting a 40 per cent drop in 2014 profits due to falling gold and silver prices.

Commodities trader and mining group Glencore – down 3.12 per cent at 282.10p – also dropped with traders linking the fall to a placing of 53.7m shares by Deutsche Bank priced at 282.45p each, compared with Tuesday’s close of 291.2p.

It was joined by insurer Legal & General, down 3.9 per cent at 267.40p after its 2014 profits fell below investor expectations, up 10 per cent to £1.3bn.

Weaker-than-expected Eurozone economic data also weighed on investors. The composite purchasing managers’ index for the Eurozone, showing European companies’ business activity, hit 53.3 in February, down from earlier estimates.

On the FTSE 250, Afren was a heavy faller, down 21.4 per cent at 7.1p, after the stricken oil producer defaulted on its 2016 bonds.