FTSE 100’s best and worst performers in 2019 so far

By Graeme Evans from interactive investor.

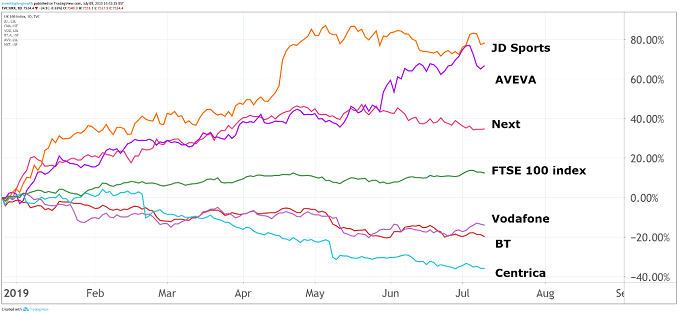

The blue-chip index jumped over 10 per cent in the first half of this year, but which one surged 68 per cent?

It’s been a year of widespread and significant gains in the FTSE 100 index, with blue-chip stocks surging by as much as 68 per cent during the first half of 2019.

A stunning total of 56 top flight companies registered double-digit percentage gains in the six-month period as London joined a global markets rebound following the pounding for shares at the end of 2018.

There were only 17 stocks in negative territory, but unfortunately for retail investors this list is dominated by popular and high-yielding stocks including British Gas owner Centrica (LSE:CNA), BT Group (LSE:BT.A) and British Airways operator International Consolidated Airlines Group (LSE:IAG).

In contrast, the leading risers driving the overall 12 per cent improvement in the FTSE 100 index over the first half of 2019 feature a number of top-flight newcomers or stocks from unfancied sectors.

JD Sports Fashion (LSE:JD.) meets both criteria after defying the retail gloom to win a place at the top table in June’s Footsie reshuffle. Its shares rose 68 per cent to 605.3p in the first half as the owner of more than 2,400 stores continued to benefit from the appetite of millennials and Generation Z customers for athleisure, as well as its ever-growing international footprint.

The appearance of Next (LSE:NXT) as the other retailer on the top 10 list may surprise some, given how tough conditions are on the high street. Shares surged 40 per cent in the first quarter of 2019 alone as Next’s trading resilience and prodigious cash generation enabled an increase to the dividend and completion of yet another share buy-back.

Next is not alone in having built most of its gains in the first quarter of 2019, when it became clear to investors that global monetary policy would remain looser for longer than expected. And from a UK investment perspective, annual results and accompanying dividend announcements have been supportive in the face of so much Brexit uncertainty.

Source: TradingView Past performance is not a guide to future performance

Software solutions firm Micro Focus International (LSE:MCRO) has enjoyed a much better 2019, with its share price rise of 49 per cent mostly achieved in the first quarter of the year. Today’s solid trading update highlighted why it has been able to keep the shares above the 2,000p threshold.

Industrial software company AVEVA (LSE:AVV) is another recent newcomer to the FTSE 100 Index after shares rose 67 per cent in the first half. The Cambridge-based firm is continuing to benefit from last year’s transformative tie-up with Schneider in which the German company took a 60 per cent stake.

The deal helped the specialist in engineering design and 3D visualisation to significantly increase its presence in North America and reduce exposure to cyclical oil and gas through Schneider’s specialisms in food, beverages and pharmaceuticals.

While growth stocks like AVEVA have handsomely rewarded investors, there’s been plenty of uncertainty and disappointment for those seeking an income from established top flight stocks.

This is most apparent at Centrica, where expectations are high that CEO Iain Conn will soon have to reduce the long-time 12p a year dividend payout, which currently yields near to 14 per cent.

Headwinds are fierce as British Gas continues to lose customers to alternative suppliers, but as our chartist John Burford pointed out yesterday an 8p dividend would still yield 6.6 per cent based on a 120p target price.

Vodafone (LSE:VOD) boss Nick Read has already taken the tough decision to cut the dividend, with the company’s first ever reduction blamed on the need to protect resources already strained by 5G spectrum auctions and infrastructure demands.

Shares fell 15 per cent to 133.95p in the half year, although UBS said last month that the stock can re-rate as operating momentum gradually improves and trading overhangs disappear.

New BT Group boss Philip Jansen protected the company’s dividend in his maiden annual results in May, but that’s failed to prevent the shares falling 17 per cent in the first. Similar fears also meant high-yielding Imperial Brands (LSE:IMB) fell 22 per cent.

| 10 biggest FTSE 100 winners so far in 2019 | ||

|---|---|---|

| Company | Ticker | +/- |

| JD Sports Fashion (LSE:JD.) | JD. | 68.1 |

| AVEVA Group (LSE:AVV) | AVV | 67.0 |

| Micro Focus International (LSE:MCRO) | NCRO | 49.2 |

| Halma (LSE:HLMA) | HLMA | 48.1 |

| Ocado (LSE:OCDO) | OCDO | 47.7 |

| Spirax-Sarco Engineering (LSE:SPX) | SPX | 47.2 |

| 3i Group (LSE:III) | III | 44.0 |

| Next (LSE:NXT) | NXT | 38.5 |

| EVRAZ (LSE:EVR) | EVR | 38.4 |

| Ashtead (LSE:AHT) | AHT | 37.7 |

| 10 biggest FTSE 100 losers so far in 2019 | ||

| Company | Ticker | +/- |

| Centrica (LSE:CNA) | CNA | -34.9 |

| TUI (LSE:TUI) | TUI | -31.4 |

| Sainsbury’s (LSE:SBRY) | SBRY | -26.1 |

| International Consolidated Airlines Group (LSE:IAG) | IAG | -22.8 |

| Imperial Brands (LSE:IMB) | IMB | -22.3 |

| BT Group (LSE:BT.A) | BT.A | -17.5 |

| Vodafone (LSE:VOD) | VOD | -15.4 |

| ITV (LSE:ITV) | ITV | -13.5 |

| Pearson (LSE:PSON) | PSON | -12.7 |

| Bunzl (LSE:BNZL) | BNZL | -12.3 |

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation, and is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.