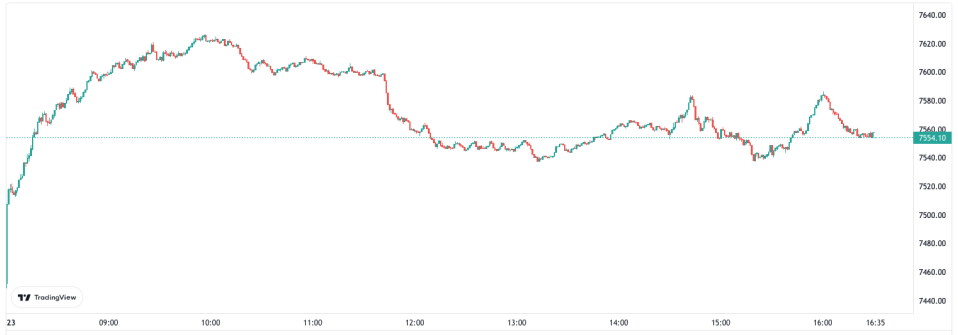

FTSE 100 shakes off January blues to pop on first trading day of 2023

The FTSE 100 shrugged off the January blues today to fly 1.37 per cent on the first trading day of 2023.

London’s premier index was kicked higher by oil giant BP popping 1.5 per cent, while the growing likelihood of a rebound in Asian travel as China dismantles its tough zero-Covid policy pumped shares in British Airways owner IAG and engine maker Rolls Royce more than four per cent.

A near one per cent weakening in the pound also lifted the FTSE 100. A large proportion of the index’s constituents book their earnings in overseas currencies, bumping their sterling-based income.

The domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, skidded around 1.4 per cent higher today as well.

FTSE 100 starts 2023 strongly

Risk sentiment also improved despite traders bracing to navigate a tough new year in which in the UK economy is likely to slide into a long recession sparked by high inflation and interest rates.

Analysts said today that London’s flagship index batted away the economic gloom to start the year on a bright note.

“In the UK, the premier [FTSE 100] index opened the year on the front foot in early exchanges, driven by mark-ups across various sectors, such as oils and banks,” said Richard Hunter, head of markets at trading platform Interactive Investor.

“In addition, the possibility of increased Asian travel also boosted the likes of International Consolidated Airlines and Rolls-Royce, while the initial risk-on approach came at the slight [expense] of the more defensive sectors,” he added.

The early year rise extends 2022’s resilient performance, with the FTSE 100 stretching out a gain of 0.9 per cent for the year, as well as an average dividend yield of 3.7 per cent.

The rally, fuelled by the UK’s oil mega caps and the relative low density of growth tech stocks listed in the City, meant the index became a favourite among international money managers.

The mid-cap FTSE 250 did not enjoy such a boost last year. It shed nearly a fifth of its value as the UK economy slumped into the early stages of what is expected to be a long recession.