FTSE 100 closes higher and US stocks jump amid election uncertainty

The FTSE 100 closed on a high and US stocks shot up as traders sought out the safety of recent corporate success stories in the face of a knife-edge presidential election.

Wall Street’s major indices all opened higher as the race for the White House went down to the wire, despite investors remaining worried about the prospect of a contested result.

Read more: US election live: Biden and Trump race will be decided in Rust Belt states

The FTSE 100, helped by a weaker sterling after a choppy start to the session, closed 1.7 per cent higher at 5,883 points.

In New York, the S&P 500 climbed 3.4 per cent in early trading, while the Dow gained 2.8 per cent.

The tech-heavy Nasdaq led gains, however, as investors rushed to buy up big technology names. It shot up 4.5 per cent.

Investors brace for close US election result

The results of the US election have proved far closer than polls had predicted, potentially leaving the outcome of the vote in doubt for days to come.

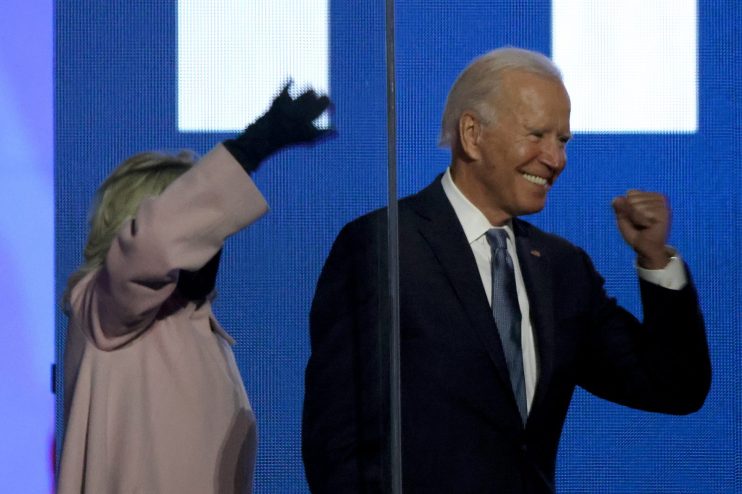

Trump and his Democratic rival Joe Biden both still have possible paths to reach the needed 270 Electoral College votes to win the White House, as states keep counting mail-in ballots that surged amid the coronavirus pandemic.

Before the Open newsletter: Start your day with the City View podcast and key market data

Shortly after his Democratic rival Joe Biden said he was confident of winning once all votes were counted, Trump falsely claimed victory and said he would go to the Supreme Court to fight for the victory if needed.

Markets take ‘win-win attitude’ to poll

Despite the uncertainty markets have not been hugely volatile throughout the day, although that could change as more states declare.

“[The markets] seemed satisfied to know that there is unlikely to be a ‘blue wave’ – a Democratic clean sweep of both houses of Congress and the Presidency – meaning the likelihood of large tax increases and increased regulation from the next administration is low,” said Randeep Somel, equities fund manager at M&G Investments.

Read more: Eyes turn to the Federal Reserve as markets await US election result

“Investors seem to be taking a kind of win-win attitude to the election,” said Connor Campbell, Spreadex financial analyst.

“Yesterday’s growth was based on the hopes of a blue wave-led stimulus package. Now that the race is much tighter, and the Democrats have little chance of taking the Senate, the markets are celebrating the likelihood of preserved tax cuts and no healthcare reform.”

FTSE 100 regains steam

A weaker pound helped lift the FTSE 100 into the green in lunchtime trading, with shares in dollar earnings climbing after sterling slipped one per cent against the dollar.

British American Tobacco rose sharply, while shares in Experian and Rentokill also climbed.

Banking and commodity stocks were among the FTSE 100’s biggest fallers after leading a surge in UK equities earlier this week on bets of a decisive victory that could pave way for more economic stimulus.

After a shaky start to the session, the FTSE 100’s European peers also closed in the green.

The pan-continental Stoxx 600 rose 1.9 per cent, while France’s CAC 40 jumped 2.4 per cent. In Germany, the Dax climbed two per cent.