FTSE 100 plagued by string of downbeat results

London’s FTSE 100 today was weighed down by investors ditching retail and leisure firms after several large players in the sector revealed they have been hit by the UK economic slowdown.

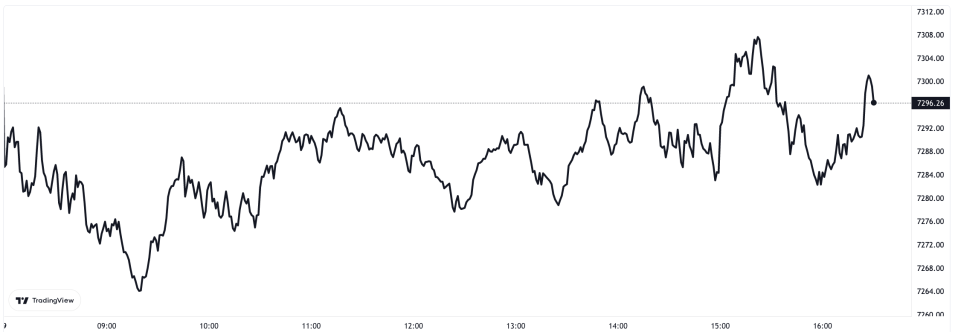

The capital’s premier index edged 0.14 per cent lower to 7,296.25 points, while the domestically-focused mid-capo FTSE 250 index, which is more aligned with the health of the UK economy, dropped 0.26 per cent to 18,649.

FTSE 100 edged slightly lower today

British high street stalwart Marks and Spencer said profits slumped 24 per cent over the first half of the year and warned of a “gathering storm” of swelling costs and a consumer spending pull back in response to high inflation plaguing its finances.

Those downbeat results pushed M&S’s shares, listed on the FTSE 250, 3.37 per cent lower and to near the bottom of the mid-cap index.

Analysts warned M&S’s mid to upper market position could be its Achilles’ heel over the next year.

“It doesn’t sit in the luxury space where the clientele is insulated from cost-of-living pressures nor does it offer the kind of value on offer from discount chains and grocers,” Russ Mould, investment director at AJ Bell, said.

Budget pub chain JD Wetherspoon also warned of rising costs eroding its finances, forcing it into selling 39 pubs.

The firm’s shares tumbled yesterday, shedding 6.31 per cent to finish second bottom of the FTSE 250.

The pound weakened over one per cent against the US dollar. UK borrowing edged lower.

US stocks opened lower after midterm elections looked set to tip the senate and house marginally in favour of the Republicans.