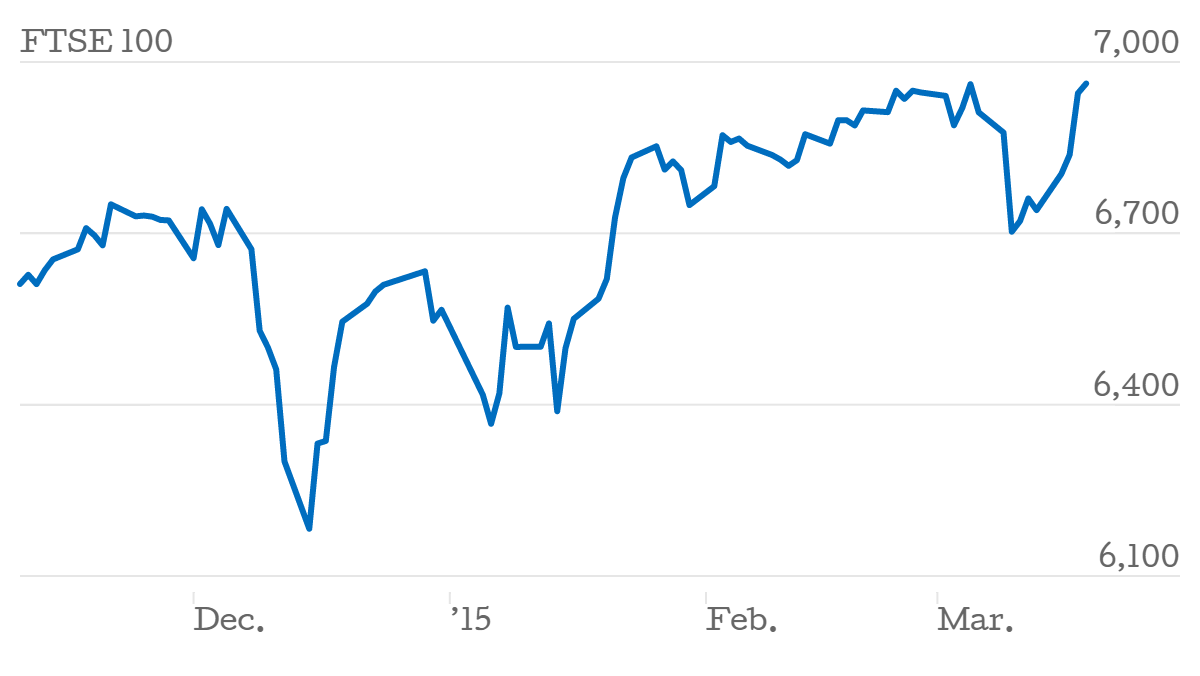

FTSE 100 closes above 7,000 as Europe agrees Greece deal

The FTSE 100 closed about 7,000 points this evening, ending the day at 7,022 after breaching the "psychological" barrier for the first time this afternoon as Europe agreed a further bailout deal for Greece.

It's the first time the index has ever risen as high as 7,000 – in 1999 it rose to 6,750, before dropping as the dot-com bubble burst.

But it finally reached that level last month. This week shares have edged up after a strong Budget.

This afternoon European ministers offered Greece a further €2bn (£1.4bn) in unused development funds. Crucially, Greek prime minister Alexis Tsipras said German Chancellor Angela Merkel had agreed to "forget the commitments of the previous Greek government", suggesting the Germans have decided to be lenient on tight bailout conditions imposed on Tsipras' predecessor.

However, the Greeks will still have to meet a primary budget surplus target of one to 1.5 per cent of GDP.

Stocks rose this morning after Tullow Oil – which is due to be demoted out of the index this evening – jumped 5.8 per cent on the news it had raised $450m of funding.

Having been pushed higher by a positive reaction to the chancellor's Budget earlier this week, the FTSE rose to an all-time high of 6,988 in early afternoon trading.

Tullow has suffered in recent months as the price of oil has plummeted, but this morning it announced it had negotiated an increase in its reserve-based lending facility from $3.5bn (£2.4bn) to $3.7bn, and pushed up its corporate credit facility from $750m to $1bn.

Charted: How the FTSE 100 reached 7,000

Although oil prices are expected to get worse before they get better, that provides Tullow with an extra $3bn of funding, meaning it has additional wiggle room.

However, over the past year, shares in the company have fallen from a high of 899p in May 2014 to a low of 281p on Monday of this week.

At the beginning of March, the London Stock Exchange announced Tullow would be demoted to the FTSE 250 in a reshuffle, due to take effect after today's close.

More: What's in a name for the FTSE 100 bosses?