FTSE 100 live: Ocado steams ahead again as analysts warn banks have long road to recovery

London’s FTSE 100 scaled higher today lifted by middle class favourite and online supermarket Ocado extending its strong rally this week.

The capital’s premier index climbed 0.32 per cent to 7,588.65 points, while the domestically-focused mid-cap FTSE 250 index, which is more in tune with the health of the UK economy, bumped 0.73 per cent higher to 18,767.90 points.

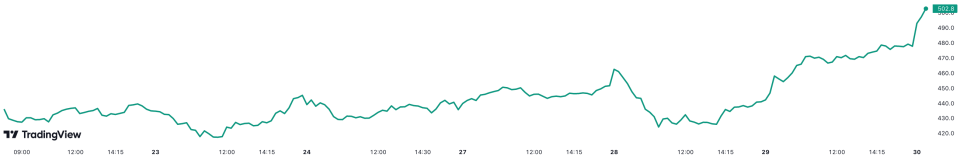

Traders have piled into Ocado this week after it set out a decent batch of results at the start of the week.

The digital only supermarket surged more than three per cent during opening exchanges, taking its cumulative weekly gains to around 12 per cent.

This week’s charge marks a reversal from last year’s dismal time which saw Ocado come in as among the worst performers on the FTSE 100.

But, over the last year, the company’s share price has still lost more than half its value.

Financials anchored the premier index, with insurer Aviva and Phoenix Group sinking to the bottom of the FTSE 100, each losing more than three per cent.

Ocado share price over last week

Sentiment has been lifted in recent days by tremors in the banking system calming down.

Europe’s top indexes are all up so far this week, led higher by its biggest banks notching strong gains.

However analysts highlighted it will take some time for UK banks to retrace their losses since the start of the banking crunch.

“Despite the lessening turmoil and with UK banks having recovered some share price strength over recent days, the recent volatility has certainly left its mark,” Richard Hunter, head of markets at Interactive Investor, said.

“Since just before the Silicon Valley Bank announcement three weeks ago, Lloyds Banking shares have fallen by 7.8 per cent, NatWest by 9.8 per cent, HSBC by 11 per cent, Barclays by 12.6 per cent and Standard Chartered by 22 per cent.”

“This particular road to recovery still has some way to go before the banks can be recognised once more as liquid and stable investment destinations,” he added.