FTSE 100 close: Ocado drags London premier index into red as pound strengthens after Sunak clinches Brexit deal

London’s FTSE 100 lost ground again today, held lower by middle class favourite and online supermarket Ocado tumbling after it said losses have widened.

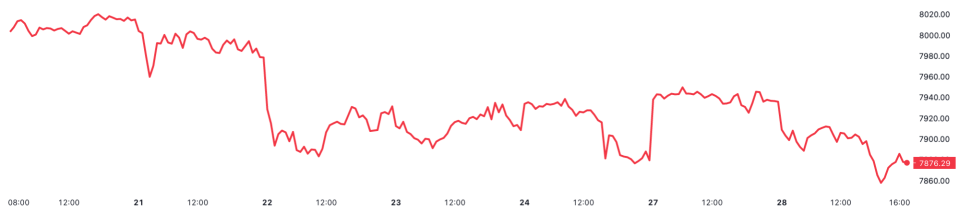

The capital’s premier index fell 0.74 per cent to 7,876.29 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, was broadly flat at 19,903.28 points.

The firm reaped in the rewards of Brits switching to online supermarkets to do their weekly shop amid lockdowns to stem the flow of Covid-19 infections.

However, demand has flowed back into bricks and mortar stores after virus curbs were lifted, weighing on Ocado’s performance.

Richard Hunter, head of markets at interactive investor, said: “Ocado is caught between a rock and a hard place, as the two elements of its business continue to face different tests.”

FTSE 100 is lower over last week

“The Solutions business, on which most of the group’s hopes for future growth and profitability is pinned, has yet to deliver on a sufficient scale to appease investors,” he added.

Ocado Solutions provides automated warehouse management services for supermarkets.

Fund managers abrdn reversed a big drop during early exchanges to close up more than five per cent despite the firm announcing today it swung to loss last year, placing it at the top of the FTSE 100.

However, wealth manager St James’s Place also approached the index’s summit, advancing around three per cent.

The premier index’s early 2023 rally has lost some steam of late after it climbed above 8,000 points for the first time ever. It finished down last week and has shed over 1.7 per cent over the last two days.

On the mid-cap FTSE 250, budget airline Wizz Air lost some altitude, stumbling more than three per cent.

The pound strengthened 0.35 per cent against the US dollar.

Oil prices jumped more than two per cent.