FTSE 100 close: Global banking rout weighs on index as budget does little to lift sentiment

London’s FTSE 100 slumped this afternoon as the banking sector faced a major sell-off following concerns over the future of Credit Suisse.

The capital’s premier index closed 3.83 per cent lower at 7,344.45 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, shed 2.63 per cent to close at 18,625.85 points.

The FTSE’s banking giants were amongst the worst performers. Lloyds closed down 4.4 per cent, NatWest 5.7 per cent, HSBC 5.8 per cent while Barclays was down 9.1 per cent as yesterday’s recovery in the banking sector reversed.

Europe’s other major markets were pulled down by banking stocks with the DAX falling 3.4 per cent and the CAC falling 3.3 per cent. The European-wide Stoxx 600 banking index was down 6.9 per cent.

Banks came under pressure as speculation over the future of Credit Suisse grew. Its largest shareholder, the Saudi National Bank, ruled out making further capital injections into the bank for regulatory reasons.

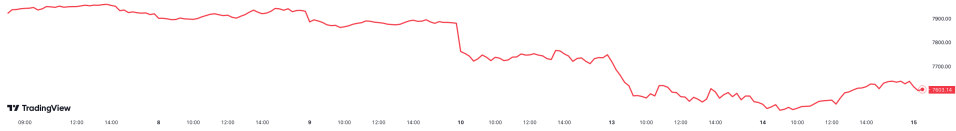

FTSE 100 is down sharply over last week

Credit Suisse closed around 24 per cent lower on Wednesday having traded as much as 30 per cent earlier in the day.

Hargreaves Lansdown’s Susannah Streeter said “the fresh banking sell-off has taken hold as fears rise to the surface about the robustness of sector with the shadow of the SVB collapse still looming large.

“Investors took fresh fright after Credit Suisse’s problems multiplied. Shares in the bank plummeted by 20 per cent after key investor Saudi National Bank turned down the role white knight and refused to ride to the rescue,” she continued.

The market downturn came despite a budget from Chancellor Jeremy Hunt that focused on expanding Britain’s workforce.

Hunt unveiled sweeping childcare policies; abolished the lifetime allowance on tax-free pensions; and announced tax breaks for firms investing in research and development (R&D).

But the divisive six per cent hike in corporation tax will remain and the UK is on course for a post-war peak tax burden of 37.7 per cent of GDP.

The UK will not enter recession this year, per the Office for Budget Responsibility (OBR) and is meeting its fiscal rules, Hunt said, adding the economy was “proving the doubters wrong.”

But Institute for Fiscal Studies (IfS) boss Paul Johnson said while OBR optimism handed Hunt “room for manoeuvre”, he was now hitting debt targets by “an even smaller margin”.