FTSE 100 close: Powell interest rate warning drags London index into the red

London’s FTSE 100 was muted today as investors sweat over whether Fed chair Jerome Powell’s warning that US interest rates will stay higher for longer means other central banks will follow suit.

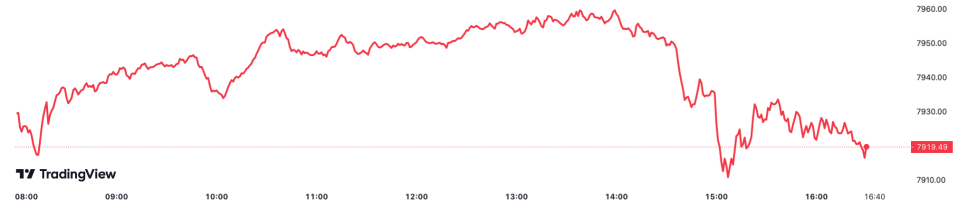

The capital’s premier index closed 0.13 per cent lower at 7,919.49 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, skidded 0.54 per cent lower to below the 20,000 point mark.

Signals that central banks are likely to keep raising borrowing costs to tackle inflation have been popping up over the last month or so, reversing market hopes that the likes of the US Federal Reserve and Bank of England were nearing the end of their respective hiking campaigns.

“It had been a fairly subdued session for European markets for most of the day, chopping between positive and negative territory amidst a backdrop of caution ahead of today’s comments from Jerome Powell, chairman of the Federal Reserve, where he struck a more hawkish tone in contrast to his last post FOMC press conference,” Michael Hewson, chief market analyst at CMC Markets UK, said.

Fed chair Jerome Powell burst investors’ hopes that the central bank is nearing the end of its aggressive rate hike campaign to tame inflation.

He warned of a “higher than expected” rate peak and put steep increases of at least 50 basis points back on the table.

The afternoon comments tipped the FTSE 100 just about into the red at the end of the day.

Wall Street’s top indexes also slipped, with the S&P 500 and Dow Jones each shedding around one per cent. The Nasdaq fell a flatter 0.5 per cent during mid-market trading.

Higher interest rates tend to knock equities by making it more attractive to buy bonds and reducing the future value of companies’ future income.

FTSE 100 slid into red after Powell’s hawkish comments

Property stocks nonetheless bumped higher on the news, with house builder Taylor Wimpey up around one per cent.

Retailers also helped the premier index stem losses, with high street retailer JD Sports and Mike Ashley’s Frasers Group each trading near the top of the FTSE 100.

The pound weakened slumped more than one per cent on bets the Fed is sticking with its tough rate increases.

Oil prices tumbled more than two per cent.