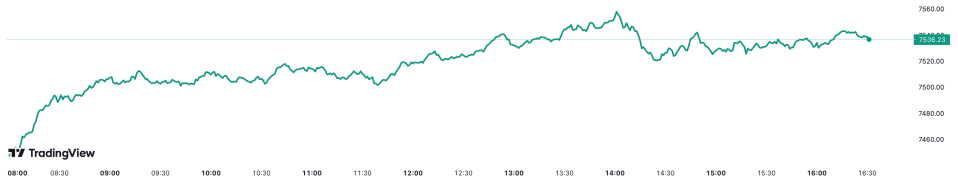

FTSE 100 close: Credit Suisse turmoil eases as Barclays and NatWest claw back losses

London’s FTSE 100 today shook off market turmoil sparked by UBS saving Credit Suisse, with the UK’s largest lenders, such as Barclays and NatWest, soaring to the top of the index.

The capital’s premier index surged nearly two per cent to 7,536.23 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, climbed 1.54 per cent to 18,779.10 points.

Markets have been highly volatile over the past few days, driven by investors digesting whether the shotgun sale of Credit Suisse to its main rival UBS could signal more trouble in the global banking system is on the way.

European banking stocks had been in freefall over the past few days, but most of them regained ground today.

Barclays surged to near the top of the FTSE 100, gaining 5.31 per cent, while NatWest advanced a similar amount.

The continent’s top lenders also bagged strong gains during opening exchanges.

FTSE 100 is down half a per cent over last week

Germany’s Deutsche Bank shot up more than five per cent, France’s Societe Generale added more than four per cent and Spain’s Santander jumped nearly five per cent.

UBS also skyrocketed around 12 per cent despite credit rating Moody’s downgrading its opinion of the firm.

“Sentiment has turned more positive across European markets with banks outperforming after the turmoil in recent sessions,” Victoria Scholar, head of investment at fund manager interactive investor, said.

Investors zeroed in on Credit Suisse over the weekend and pulled their cash out of the firm rapidly. That led to Swiss authorities to push through a shotgun sale of the bank to its largest rival UBS.

First Republic Bank, a regional American bank, has come under pressure despite a consortium of big banks injecting billions into the firm.

The pound weakened nearly one per cent against the US dollar.

Oil prices were up more than one per cent.