FTSE 100 close: Credit Suisse share price shoots up 30 per cent as HSBC and Lloyds climb in London

London’s FTSE 100 today partly clawed back yesterday’s losses that saw it clock its worst day in over a year as the index was ensnared by global markets sweating over the health of the European banking system.

The capital’s premier index jumped 0.89 per cent to 7,410.04 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, climbed 0.71 per cent to 18,758.58 points.

The gains helped offset big losses yesterday which were sparked by investors fleeing banking stocks, with European banking giant Credit Suisse taking a hammering sparked by fears over whether it would collapse without more cash.

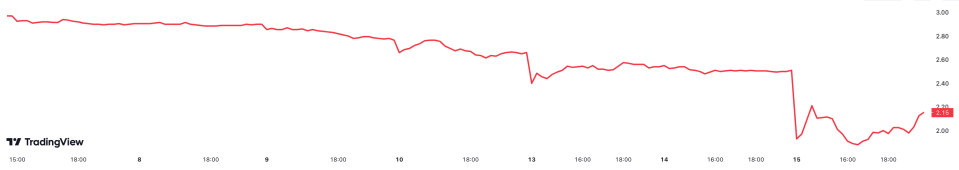

The lender slid as much as 30 per cent yesterday and was briefly trading at levels last seen since the 1980s after a top investor told Bloomberg it would not stump up any more money.

Last night, the Swiss central stepped in to fortify Credit Suisse’s finances, offering to inject around £50bn into the firm’s balance.

Credit Suisse share price

The news sent its shares soaring around 30 per cent today this morning, before eventually closing up around 20 per cent.

European banking stocks came under fire yesterday, with the likes of Deutsche Bank, Societe Generale and BNP Paribas all notching their biggest losses in years.

Emergency cash offered to Credit Suisse boosted sentiment toward European banks today.

FTSE 100 listed lenders Barclays, Lloyds Bank and Standard Chartered all traded near top of the index and were up more than one per cent apiece,

Victoria Scholar, Head of Investment, interactive investor said: “European markets are bouncing back after a volatile week for financials. Support from the Swiss National Bank for Credit Suisse has catalysed a major rally for the Swiss lender and has spurred broader risk-on sentiment.”

The pound was broadly flat against the US dollar in the day after Jeremy Hunt’s around £20bn budget, a very different picture to the days after Liz Truss’s mini budget when sterling hit a record low against the greenback.