FTSE 100 close: BP propels London index higher after posting record £23bn profit

London’s FTSE 100 was boosted by investors piling into oil giant BP , which announced its highest ever full year profits of £23bn last year.

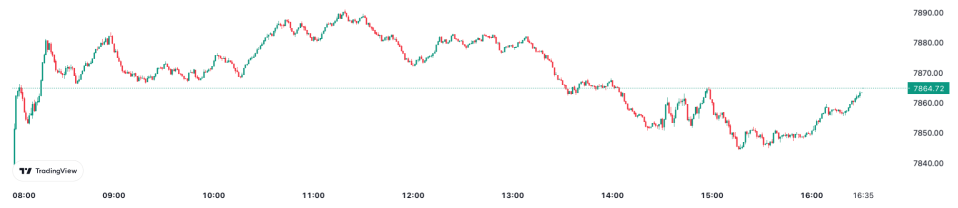

The capital’s premier index jumped 0.36 per cent to close at 7,864.72 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK economy, fell more than one per cent per cent higher to 20,189 points.

The oil megacap revealed soaring energy prices globally, fuelled by economies getting back online after the Covid-19 crisis and Russia’s invasion of Ukraine, had propelled its profits to a record high.

Its shares leapt nearly eight per cent to the top of the FTSE 100, lifting Shell, its rival, in its slipstream, up more than two per cent.

BP boosted its dividend by 10 per cent and announced more buybacks, firming up investor sentiment toward its shares.

Analysts said the bumper profit haul has enabled it to cushion the financial blow stemming from pulling out of Russia.

FTSE 100 opened higher today

Richard Hunter, head of markets at interactive investor, said: “Such immense profits have also enabled BP to withstand the major financial cost of its Russian exit as it steps away from Rosneft, as well as deploying excess capital and at the same time actually providing an upgrade to its earnings guidance for the forthcoming year.”

London banks also pulled the index higher, with HSBC, Lloyds and Barclays all up around one per cent ahead of UK banks earnings season kicking off next week.

The pound weakened slightly against the US dollar to buy. Yields on UK bonds, which move inversely to prices, were slightly higher today.

Oil prices climbed more than two per cent after BP’s rosy results.