FTSE 100 close: Standard Chartered, BP and AstraZeneca continue London index’s surge

London’s FTSE 100 continued its relentless upward march today, led higher by bank Standard Chartered and oil giant BP extending a week-long rally.

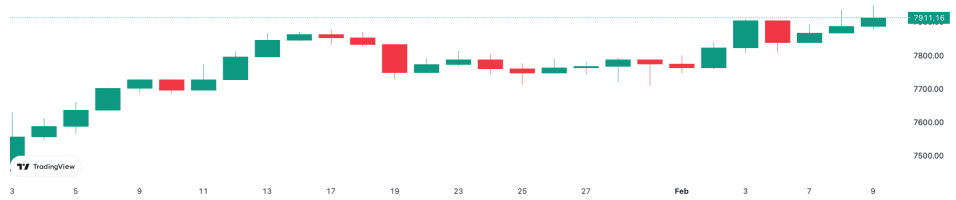

The capital’s premier index rose 0.33 per cent to 7,911.16 points, while the domestically-focused mid-cap FTSE 250 index, which is more aligned with the health of the UK, was broadly flat at 20,292.20 points.

The leap higher builds on the FTSE 100’s surge since the turn of the year, which has seen it routinely set new record highs.

Yesterday it kissed an intraday high and last Friday closed at its steepest level ever, breaking a record hit in May 2018.

So far in 2023, the premier index is up more than six per cent, putting it ahead of its European and Wall Street rivals.

A string of upbeat results out today lifted market sentiment in London.

FTSE 100 has surged this year

Pharmaceutical titan AstraZeneca climbed to become the FTSE 100’s second highest riser, adding more than four per cent.

“Core earnings per share fell 17 per cent to $1.38 but this was ahead of forecasts for $1.34. Fourth quarter revenues declined seven per cent largely on a drop in the sale of its Covid vaccine,” Neil Wilson, Finalto chief market analyst, said.

Asia focused bank Standard Chartered shot to the top of the index on rumours resurfacing that it could be subjected to a bid by First Abu Dhabi Bank. Its shares finished more than 11 per cent higher.

HSBC was also pushing toward the top of the index in the morning ahead of UK bank earnings season kicking off next week before shedding gains in the afternoon.

BP continued its strong week, up around two per cent, after it posted record profits of just under £23bn on Tuesday.

Tobacco firm British American Tobacco sank more than 2.5 per cent after it reported a drop in earnings per share despite revenue and profits rising.

The pound strengthened nearly 0.7 per cent against the US dollar. Gilt yields edged lower.

Oil prices slipped around 1.3 per cent.