Rallying retail stocks lift FTSE 250 to fresh record high

A rally among retail and consumer goods stocks drove the mid-cap FTSE 250 to a fresh record high today.

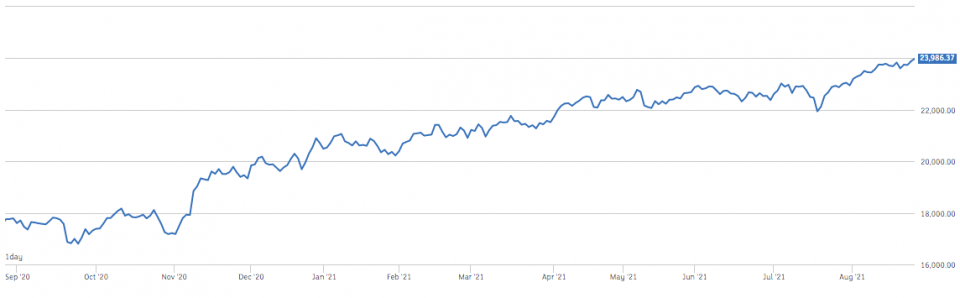

The domestically-focused mid-cap index pulled back slighlty from morning gains that saw it reach a new summit, but it registered its highest closing score ever, up 0.42 per cent today to 23,986.37 points. Over the last year, the FTSE 250 has added nearly 40 per cent.

Meanwhile, the FTSE 100, London’s premier index, registered another strong day to build on a string of positive performances this week. The blue-chip index jumped 0.34 per cent to close at 7,150.12 points.

Shares in Marks and Spencer soared over five per cent today, while a 4.29 per cent increase in Mecca Bingo operator Rank Group’s share price after HMRC decided to not challenge a VAT ruling helped to lift the mid-cap index higher.

Danni Hewson, financial analyst at AJ Bell, said: “The FTSE 250 which reached fresh highs thanks in part to a former retail giant that certainly seems to have found it’s sparkle again. Marks and Spencer enjoyed more gains as did bingo business Rank.”

Ailing sub-prime lender Amigo saw its share price plunge over five per cent after it posted a sharp rise in losses driven by the swelling cost of dealing with customer complaints related to a loan misselling scandal. Shares in the lender now cost just under 8p.

Junior market AIM also jumped into the green today, adding 0.58 per cent to reach 1,279.79 points.

The pound added 0.08 per cent against the dollar to buy $1.3740.

Winner and losers

Financials led the day’s gains on the FTSE 100 driven by a slight rise in bond yields.

Bookmaker Flutter topped the table of risers, climbing 3.51 per cent to hit 14,435p, which could have been driven by market sentiment toward the gambling trading environment improving after the latest developments in Rank’s dispute with HMRC, Hewson said.

Banking giant Standered Chartered came second, up 3.1 per cent to 481.90p. Weir Group placed just behind the bank, rising 2.98 per cent to 1,694.50p.

Michael Hewson, chief market analyst at CMC Markets UK, said: “Industrials have also performed well with Weir Group, near the top of the index after Credit Suisse said that the recent declines in the share price had created an attractive entry point for investors.”

Aerospace engineer Rolls-Royce topped the fallers column, sliding 1.52 per cent to 116.48p, while water supplier Severn Trent dipped 1.48 per cent to 2,790p.

Around the world

Wall Street followed London’s strong performance, with two of the US’s major benchmarks all trending toward closing highs today.

The S&P 500 was up 0.26 per cent to 4,497.85 in late afternoon exchanges, while the Dow Jones gained 0.16 per cent to hit 35,421.85 points.

The tech-heavy Nasdaq reached yet another record high during the morning session, before edging back slighlty. The index was up 0.16 per cent to 15,044.22 points after five hours of trading.

All three major US stock indexes advanced higher yesterday, with the S&P 500 and the Nasdaq closing at all-time closing highs, the 50th time the former has done so this year alone.

Interactive Investor head of markets Richard Hunter said that at present a “Goldilocks” scenario was playing out in the US, “with economic data suggesting that the recovery may be on track, but not to the extent of overheating”.

“As such, and ahead of comments from Federal Reserve Chairman Powell later in the week at Jackson Hole, there are some strong foundations in place with some analysts expecting that the major indices have further to go”, he added.

Asian shares were muted in overnight trading, with Japan’s Nikkei inching down 0.02 per cent to 27,724.80 points and China’s CSI 300 up 0.2 per cent to 4,898.16 points.

European shares registered a mixed set of performances – the pan-European Stoxx600 was up 0.01 per cent to 471.84 points, while Germany’s Dax 30 closed the day down 0.28 per cent to 15,860.66 points.