FSA clamps down on CFD investors

Rules forcing contract for difference (CFD) holders to disclose long positions of three per cent have had a mixed reaction in the City.

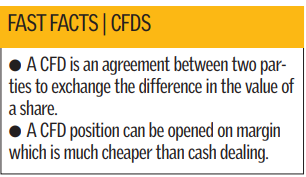

A clampdown by City watchdog the Financial Services Authority (FSA) has long been anticipated due to fears that investors are using CFDs, which give exposure to a share for a fraction of the full cost, to build stakes in companies in a less transparent way than if they had simply bought shares on the open market.

The new rules from the FSA mean that investors will have to declare net long positions worth 3 per cent or more of the outstanding stock based on a mix of share and CFD holdings.

The regulations put CFD investors on a par with the disclosure level required for share traders and with Takeover Panel rules.

Alexander Justham, FSA director of markets, admitted there was no clear market consensus, but said: “Our goal is to provide an effective and proportionate disclosure regime that works for all involved, and sustains market confidence and efficiency. We have devised a solution that meets the concerns and issues raised,” he said.

The FSA’s stance, however, is tougher than some in the industry had anticipated, in spite of it saying it had found “no compelling evidence” of inefficient pricing due to a lack of transparency.

“I am slightly surprised by where we’ve ended up as I didn’t see widespread support for this option from my buyside or sellside clients,” said Darren Fox, partner at law firm Simmons & Simmons, which has a number of hedge fund clients.

Andrew Baker, deputy chief executive of hedge fund trade body AIMA, however, said the rules could drive hedge funds away from the UK.

“We have strongly argued in favour of lighter regulation of CFDs to achieve the correct balance between an appropriate level of transparency in the market and a competitive environment for the hedge fund industry in the UK. The FSA’s intention to further regulate CfDs is not the most effective way to achieve this,” he said.

Analyst Views: What do you think of the new disclosure rules for CfDs

Graeme Dickson (Lite financial): I see it as a positive thing. CFD investors should have to play by the same rules as the traditional investor. Although I think it would be fairer to have to disclose the same level of short positions as ultimately if you are short or long you are controlling the same amount of stock. The more consistent the rules are the easier they will be to follow.

Justin Urquhart-Stewart (Seven Investiment Management): I approve of the fact that it is tightening up the rules. But it is moving too fast without thinking about the wider consequences. Yes we want transparency, but the FSA also needs to ensure we have a proper market. The aim is good however if the rules push transparency too far it becomes onerous and will distress the market. It’s probably a step too far.

Paul Kavanagh (Killik Capital): Broadly, we would be very supportive of a general disclosure regime for long Contracts for Difference positions. This can only serve to increase visibility and create a level playing field for all investors. Within Killik Capital, we operate an advisory CFD business and greater disclosure will enhance the quality of the advice offered to our clients