From Industrialized Yield Farming to Hydroponics

Over the course of 2020 the liquidity locked in decentralized finance (DeFi) protocols has grown in rapid fashion with use cases such as crypto-backed lending, decentralized exchanges (DEX’s) and insurance bringing the Total Value Locked (TVL) in DeFi to its current peak ~$15 billion with the majority of this capital existing on the Ethereum blockchain. Ethereum launched in 2015 with smart contracts, enabling users to interact with decentralized applications and programs that execute according to pre-defined logic, all open for anyone to validate on the blockchain.

To understand how DeFi is viable in the Ethereum EVM/accounts world with it’s set of inefficiencies and design tradeoffs you must actually first consider how tapped out the legacy centralized finance (CeFi) system it aims to replace already is. Look no further than U.S. 10-year corporate bonds yielding subzero for example. If smart contract technologies only provide a 5–10 basis point (0.05 — 0.10%) improvement in contract efficiency, all global debt will move to decentralized public blockchains over the medium to long term. As more global bond investors slide into subzero territory this outcome becomes increasingly inevitable. With the hunt for >1%+ real yield debt products driving investors up the CeFi risk curve, the DeFi sector is quickly becoming a more secure, high-yielding alternative for low or negative yielding CeFi capital to consider allocating funds to.

DeFi covers a range of financial products & services powered by open-source networks and smart contract automation, completely eliminating the need for centralized financial institutions. The 0 to 1 innovation that DeFi represents means the disruption approaching the banking and finance model will transform incumbent value extractors into commoditized value creators as this will be the only option for these players to exist in the value chain. The functional result is end-users placed at the center of the value chain as the key value creator. Decentralized means DeFi products are globally accessible 24/7, 365 days a year. Anyone, anywhere can trustlessly interact with the DeFi protocols or build on top of this open financial infrastructure.

DeFi lending protocol Compound Finance revolutionized the playbook for incentives to achieve growth volume through the introduction of protocol layer liquidity mining linked to the COMP governance token distribution. Yearn showed us all the power of rapid governance feedback loops in DeFi protocols, even if it meant ‘testing in prod’. Both of these protocols helped pave the way for what’s become the standard in liquidity incentives & tight feedback loop governance models. Our Liqwid team has learned a lot from the prior innovation as well as pitfalls in the early DeFi protocols. From these lessons we are developing Liqwid, as an alternative to the current DeFi protocol tradeoffs and to pave the trail for DeFi teams building on the Cardano blockchain.

Liqwid is the next generation of yield farming for the next generation of farmers:

Liqwid is an algorithmic protocol for lending and automated liquidity provision currently in development and set to launch on the Cardano blockchain late Q1 2021. Liqwid enables Cardano ADA and/or stablecoin holders to earn interest on their digital asset deposits and borrow crypto-assets. Liqwid loans are automated by a set of smart contacts on the Cardano chain that determine the most efficient rates for borrowing or lending based on current supply demand rates. Each Liqwid Pool has a variable rate calculated by the protocol’s interest rate model for lenders derived from the supply-side liquidity and borrow-side demand. As discussed in the Intro to Liqwid Medium article, DeFi lending annual percentage yields (APY) significantly outpace the yields equivalent CeFi lending products generate. Higher yields on DeFi instruments can be attributed to assumed higher risk levels combined with the process efficiencies unlocked by smart contracts and decentralized autonomous organization (DAO) technologies.

The Liqwid core team believes in the DeFi core ethos of trustless and borderless access to financial infrastructure without the hurdles many emerging market participants are faced with today. Legacy CeFi barriers to entry such as identity and prior credit history are replaced with a suite of smart contracts capable of automating each step in the end-users process flow to borrow or lend by auto-calculating borrow & earn rates in a dynamic ‘peer to pool’ model. All of the smart contract logic and metadata lives on the Cardano public chain and can be viewed by anyone, maintaining another core DeFi tenant of transparency.

Inline with another DeFi key element, the Liqwid protocol is 100% non-custodial. Functionally this means users retain complete control of their deposited crypto-assets at all times and can add or remove liquidity anytime they decide. The unlimited banking hours inherent in DeFi products also require end-user obligations to securely store their funds with no centralized financial institution to serve as a reset.

In the future (post v1) Liqwid aims to introduce functionality that more directly competes with CeFi bank & fintech product offerings beyond the ‘Kosher’ DeFi crypto-backed lending protocol our team is developing for v1. To allow this, future Liqwid versions will include user opt-in identity features through an integration with Cardano’s Atala Prism decentralized identifier (DID) framework and credit features via the LiqwiDAO delegation process.

Liqwid’s CFO, CTO and product leads join the team from audit, finance and IT backgrounds working with Swiss and German banks & fintechs and our team will use this existing network to streamline the process of future product offerings utilizing CeFi banks & fintechs as a white labeling service for compliance and regulation across jurisdictions. This would enable Liqwid to build bespoke hybrid DeFi products that rely on 100% opt-in CeFi touchpoints to introduce more capital efficient product offerings that directly compete with CeFi products: 0% collateral lending, ETFs and mortgage-backed securities for example. While not in scope for the v1 protocol this is the future-vision state functionality that will make its way into the protocol in future releases.

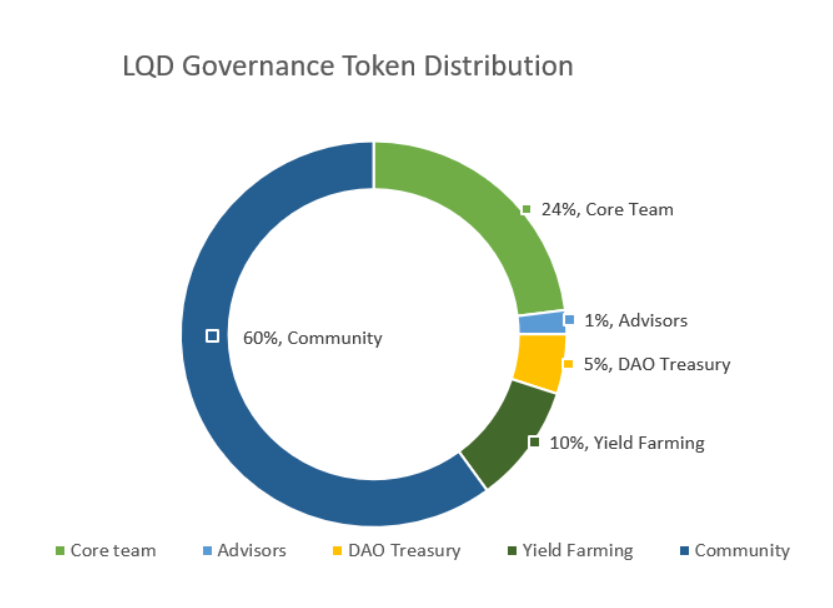

To begin decentralisation from day 1, Liqwid user’s will receive $LQD governance tokens for supplying or borrowing from Liqwid Pools pro-rata. This process is set to begin with the v1 launch and the team will be sharing additional details leading up to the event start. This will be a fair-launch token distribution and our team is aiming to have as large an initial user base as possible. 75% of LQD governance tokens are allocated for distribution to Liqwid protocol users and the LiqwiDAO Treasury which is governed by protocol users and used to update the future system as required. Cardano $ADA has already the most liquidity locked in a Proof of Stake network and with the upcoming protocol upgrade to a multi-asset ledger the introduction of stablecoins and other native tokens will scale Cardano’s total on-chain liquidity to higher highs.

Liqwid Governance: $LQD

$LQD is the protocol’s governance token and coordinating mechanism that will be used for voting, introducing new proposals and distributing dividend cash flows. The Liqwid team has analyzed the complete set of risks & responsibilities needed to ensure Liqwid governance distribution is a fair-token launch alongside a vibrant community-led DAO set of best practices. For an in depth review of the LiqwiDAO and Treasury model this intro to Liqwid governance covers the entire governance module in current development for v1 launch:

Yield farming in its current form popularized by the Compound COMP distribution has become a DeFi standard allowing projects to bootstrap their communities and liquidity (TVL) through incentives created by distributing the protocol’s governance token and when correctly implemented mitigates entire classes of protocol risks related to; genesis token distribution (VC/pre-sales), community formation & support strategies, and long term liquidity. The latter-most is fundamental to constructing a viable system capable of servicing borrow demands with supply-side liquidity at all times. The incentives and game theory analysis the Liqwid protocol architects have completed leading into v1 development will help ensure that this distribution event encourages longer term liquidity supplying over the short term ‘mercenary capital’ that’s become standard in Ethereum DeFi (e.g. Uniswap to Sushiswap) and more closely align the protocol incentives (and disincentives) with the Liqwid community’s future state vision.

The majority of $LQD are allocated for the protocol users:

Sustainably sourced digital hydroponic farming is coming to the Cardano ecosystem in Q1 2021. Liqwid is excited to lead with $LQD paving a new path for community led DeFi projects on Cardano.

If anyone is interested in becoming more involved with the project the Liqwid legion of ~100 eco-friendly digital hydroponic farmers are helping the core team build Liqwid v1 and contributing high-quality discussion along the way, join on the Liqwid Discord!

Project Catalyst: Cardano’s ‘VC in the Cloud’

The Liqwid core team is competing in Cardano’s Project Catalyst to receive grant funding to allow them to scale up developer bandwidth as they transition from protocol design to full sprints for v1 development. The Liqwid core developers will work with the Appinventiv Blockchain/DeFi team as well as the Tweag Haskell experts to formally verify and internally audit the protocol components leading up to v1 launch.

The Voltaire phase of Cardano has introduced Project Catalyst, the first public funding round on the blockchain enabling teams building Cardano based solutions to request funding amounts for proposals and the community of ADA holders to vote on these proposals in iterative rounds every 6-8 weeks. Fund2 has served as a powerful first step into the uncertain but thrilling Wild West-like landscape of decentralized on-chain governance for this entire ecosystem and the Liqwid team is excited to become apart of the 1st cohort of funded projects building protocols on the Cardano chain today to drive on-chain value flow for the entire community of Cardano ADA holders in the future. To learn more or check out the full Liqwid proposal for fund2 in Ideascale: https://cardano.ideascale.com/a/dtd/Liqwid-Cardano-DeFi-Lending-Markets/322338-48088.

So why Cardano?

The Cardano blockchain provides a low cost, highly performant and secure blockchain to deploy Liqwid’s suite of smart contracts and the LiqwiDAO governance module upon. Capabilities native to Cardano’s extended UTXO protocol layer enable the best of expressiveness and functional resource determinism critical to Liqwid’s approach to smart contracts on the blockchain and in the end what makes Cardano the most natural fit blockchain for Liqwid (or any DeFi protocol) to thrive with functionally non-replicable on 2nd generation blockchains such as Ethereum. The order of magnitude cost savings, predictability and protocol efficiency of transacting on the Cardano chain will result in a higher Profit and Loss (PnL) meaning the gains for the Liqwid protocol automatically distributed pro-rata to LQD token holders will be a significantly larger margin compared to the exact same scenario on Ethereum. Liqwid is a more efficiently operating money market and since deployed on Cardano the protocol PnL accruing to the protocol owners ($LQD token holders) will represent a significantly higher percentage compared to Ethereum DeFi where most fees accrue to ETH miners with liquidity providers (*protocol value creators*) forced to accept low-margin protocol profits.

Summary:

In conclusion, the team at Liqwid is committed to delivering a new standard in DeFi user experience on a blockchain with technology robust enough to power a global financial system yet functional enough to fade into the backdrop to allow protocol architects, product leads and app developers to build great user experiences. The Cardano community reached unimaginable heights even in a year as chaotic as 2020. Through it all this community grew and evolved and in Q3 2020 witnessed the birth of community-led DeFi protocols with the Liqwid legion of hydroponic farmers. We are heads-down as we push into full sprints for the course of v1 development from now through January 2021. At this time our team will begin inviting beta testers in to try the protocol and assist us in quality assurance. There is much more to be announced from our team leading up to v1 launch so stay tuned.

From the Liqwid team to yours, have a happy, safe holidays!

Dewayne Cameron, Management Consultant, Founder – Liqwid Finance