‘Fragile’ UK at risk from ‘another acceleration’ in business insolvencies, Allianz warns

Corporate insolvencies could climb 10 per cent this year Allianz has warned, stating the UK is more exposed than other European nations to a spike in business insolvencies.

The insurer’s global insolvency outlook estimated 15 per cent of small and medium-sized businesses in the UK are at risk of going bust, the highest proportion of “fragile firms” in Europe.

This compared to 14 per cent in France, nine per cent in Italy and seven per cent in Germany.

Firms which rely on discretionary spending – such as retail and manufacturing – are most at risk from weaker-for-longer demand and higher borrowing costs, the report said. Construction and real estate businesses are also particularly exposed.

“After a succession of challenges (Brexit-related issues, Covid-19, earlier monetary tightening and rapid and sticky inflation), we expect domestic firms to continue to struggle as the economic outlook for 2024 remains weak, with GDP growth set to only gradually exit the recession zone,” the report said.

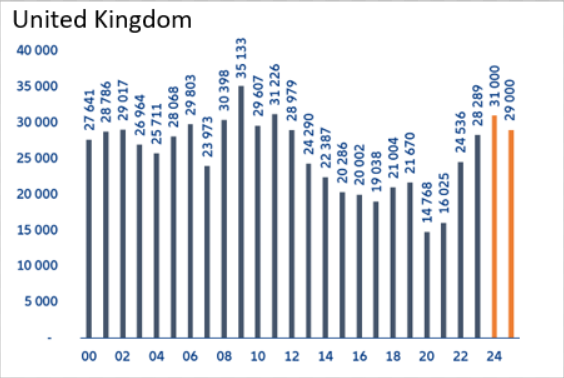

Insolvencies climbed to a thirty-year high in 2023 as firms struggled under the weight of the Bank of England’s rate hikes. Interest rates were raised from 0.1 per cent at the end of December to a post-financial crisis high of 5.25 per cent.

The Bank’s rate hikes also helped tip the UK into a shallow recession in the second half of last year.

Although markets think interest rates will fall this summer, the worst is still to come in terms of insolvencies. Allianz predicted that as many as 31,000 firms could go bust this year. This will then fall to 29,000 in 2025.

The UK is not alone in seeing a surge in insolvencies, as firms around the world adjust to the impact of higher interest rates.

Business insolvencies globally picked up 29 per cent in 2023, the fastest increase since the financial crisis. This was driven by the US, which recorded a 47 per cent increase on the year before

Allianz said they expected “another acceleration in global business insolvencies” in 2024, before stabilising in 2025.