Four things we learned from Barclays results

Barclays delivered a mixed set of results for the third quarter today, with strong performance in its controversial investment bank outweighed by a massive £1.4bn PPI claims hit.

These are the top four takeaways from Barclays results today.

Barclays was not expecting PPI ‘avalanche’

Barclays otherwise strong third quarter results were torpedoed by a whopping £1.4bn provision for payment protection insurance (PPI) mis-selling claims.

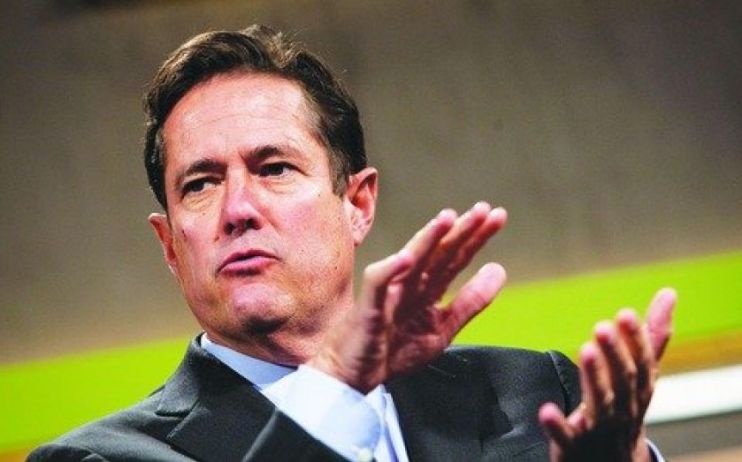

Chief executive Jes Staley told reporters that the bank was not expecting the flood of PPI claims that inundated the bank in the run up to the 29 August deadline.

“What we missed quite frankly…was the avalanche of PPI in August,” he said.

“We were not expecting a provision of close to £1.5bn…we hope this is the last of the major litigation and conduct charges,” he said.

Read more: Investment banking boost helps Barclays despite £1.4bn PPI charge

In response to a question about future share buybacks Staley said the quarter showed the bank’s ability to generate capital.

“I think the quarter demonstrates our ability to generate excess capital – but unfortunately instead of going to shareholders this quarter it went to PPI claimants,” he said.

Neil Wilson, chief market analyst at Markets.com, said the inability of banks to predict the wave of PPI claims “is a scandal in itself”.

And added: “The other great PPI scandal is how shareholders have been consistently low-balled, fobbed off and undersold the impact of the redress, leaving them with lower capital returns and lower dividends than they would have expected.

“Barclays has now spent £11bn on settling PPI claims. However, the line has been drawn under this and banks can move on at last.”

Investment bank confounds critics

Barclays has come under attack from activist shareholder Edward Bramson and his Sherborne investment vehicle in recent months, with the performance of the investment bank the key bone of contention.

The investment bank delivered profit before tax of £886m for the quarter, up 67 per cent on the same quarter last year.

The strong result strengthens Staley’s hand in dealing with Bramson and vindicates his strategy for the investment bank which he said had remained unchanged since 2016.

“We feel quite good about the range of our platform, the talent of our people and the ability to compete with the major US players,” Staley said.

“A lot of people question whether a European bank can do that.

“We can compete – the American firms are exceptionally good at what they do – but I think we have a good market team and a good banking team.”

Read more:Activist investor Ed Bramson hits back at Barclays

AJ Bell investment director Russ Mould said: “Management are having their feet held to the fire thanks to the presence of activist investor Edward Bramson on the shareholder register. He is agitating for a change of strategy – principally scaling back its investment bank.

“This part of the business was actually the star performer in the third quarter which CEO Jes Staley will likely see as ballast to keep on resisting Bramson’s pressure.”

Brexit is ‘clearly’ having an economic impact

Staley said the effect that Brexit was having on the bank’s customers was noticeable.

“Increased balances from our consumers and small businesses across the UK indicating a level of caution given the uncertainty that is a reality.

“You do see – if you look at M&A across the UK, underwriting IPOs – fairly soft volumes in those businesses. Strategic decisions taken at board level are restrained given the uncertainty. There clearly is an economic impact from the uncertainty we have around Brexit,” he said.

Read more:Barclays backs down over Post Office cash ban after backlash from MPs

Next year’s targets could be a stretch

Barclays is targeting a nine per cent return on tangible equity (Rote) this year and 10 per cent Rote next year, but warned today that meeting those goals could be tricky.

“Given global macroeconomic uncertainty and the current low interest rate environment, it has become more challenging to achieve these targets, particularly with respect to 2020,” the bank said.

“We just want to be realistic about are targets for next year. For now we are holding to the 10 per cent target…but it is a different market then we faced a couple of years ago,” Staley added.

Mould said the market was fairly relaxed about Barclays’ warnings today.

“The market is taking the latter news in its stride for two key reasons. First, most people felt this target would prove a stretch anyway so weren’t hanging their hats on the bank hitting the 10 per cent level.

“Second, its excuses for falling short look pretty cast iron and would not be a big surprise to investors. Interest rates are no longer expected to go up, and this puts pressure on the amount banks can charge to lend money. While global and domestic economic and political uncertainty remains elevated.”

Despite the gloomy forecast, shares rose 1.8 per cent to 169p this morning.