Fortis profits halve on new writedowns

Fortis was the latest bank to be hit by the credit crunch, as it announced interim profits down by 41 per cent, after a second wave of writedowns related to choppy credit markets.

The troubled Belgian-Dutch group’s net profit slumped to €1.6bn (£1.3bn) from €2.8bn in the first six months as the bank took €591m in writedowns from the credit crunch.

Net profit excluding the impact of the credit crunch was down 24 per cent year-on-year, mostly on the back of high rates of loan impairments and lower capital gains.

Acting CEO Herman Verwilst said the bank’s priority now was to strengthen its balance sheet and warned that “the credit crisis is not behind us yet.”

The bank has suffered more than most from the US subprime crisis and angered shareholders in June with a surprise €8.3bn capital-raising programme, scrapping the dividend and raising another €1.5bn of equity.

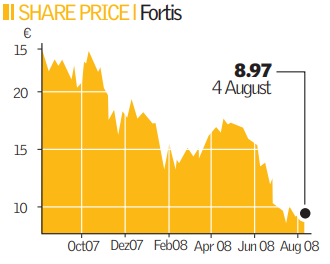

Shares in Fortis have lost two-thirds of their value since the onset of the credit crunch and dipped today to an all-time low, down 3.23 per cent to €8.97 on the Amsterdam stock exchange.

The bank was left with a market capitalisation of €21.6bn, less than the €24bn it paid earlier this year for a share of ABN Amro.

Fortis undertook a €13.4bn rights issue last autumn to fund the acquisition of the Dutch bank’s retail and wealth management units, in a heavily criticised €71bn takeover fronted by the Royal Bank of Scotland.

And it was recently forced to deny that shareholders were withdrawing their funds as its share price plunged. It now has a market cap of €20bn.