Former Financial Times owner Pearson share price up as publishing company reveals loss before tax for year ended December 2015 as sales also take a knock

Share price in Pearson rose this morning as the publishing company revealed it had fallen into a loss-making position and its sales had dipped slightly.

The publisher reported a loss before tax of £433m for its year ended December 2015, down from a profit before tax of £255m the year before.

Meanwhile, levels of sales also dipped, dropping by two per cent to £4.5bn for 2015.

Despite the setbacks, share price in the company rose, trading up 3.6 per cent at 830.5p shortly after the London market opened.

The publishing company, which sold its stake in the Financial Times and The Economist last year, also proposed a final dividend of 34p per share, bringing its overall 2015 dividend to 52p, a boost of two per cent compared with 2014.

"Our competitive performance during the last three years has been strong, but the challenges in our biggest markets have persisted for longer than anticipated," said John Fallon, chief executive of Pearson.

Last month, the company announced that it was making significant moves to cut costs, including slashing around 4,000 jobs.

Fallon added: "Pearson is now implementing the plans we announced in January to integrate our business, reduce our cost base and focus on fewer, bigger growth opportunities."

Analysts at Liberum were slightly less enthusiastic, stating that the company's declining cash flow raised doubts over how long it would be able to sustain dividends for.

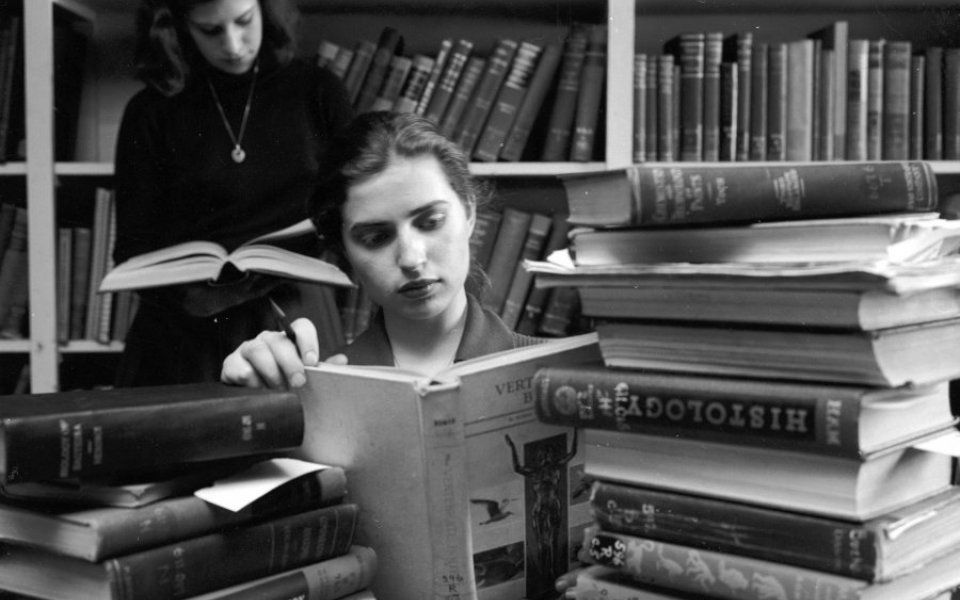

The broker also reiterated its sell position, pointing out that a shift in students' willingness to splash cash on expensive textbooks presented a challenge to Pearson's business.