Food inflation lowest level since last August, as supermarket price wars pay off

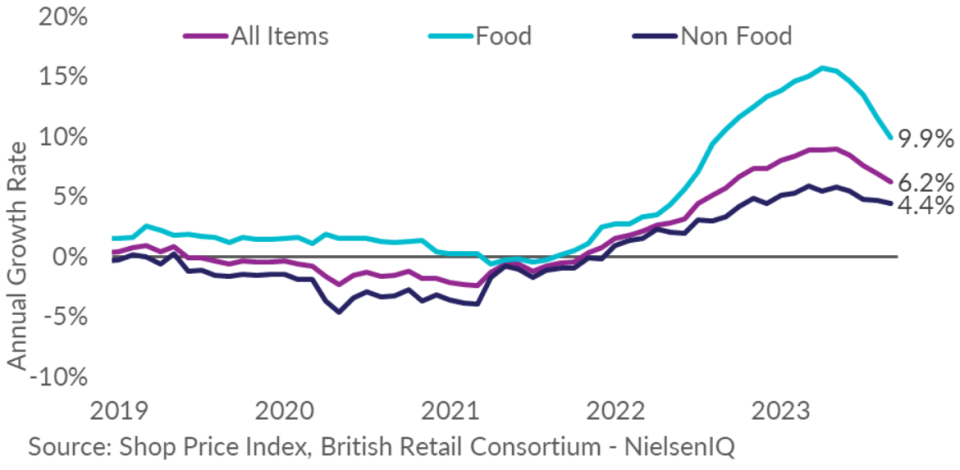

The rate at which food prices increase has fallen to 9.9 per cent in September, down from 11.5 per cent the prior month, and the lowest level since last August, in the latest signal that cost of living pressures customers face at the till are beginning to ease.

Shop price annual inflation is now also at its lowest level since last September, according to the latest analysis by the British Retail Consortium (BRC), and remains below the three month average rate of 6.8 per cent.

Fresh food inflation slowed further in September, to 9.6 per cent, down from 11.6 per cent in August and ambient food inflation, which included canned goods cooled to 10.4 per cent in the last month, down from 11.3 per cent in the prior.

Shop Price annual inflation decelerated further to 6.2 per cent in September, down from 6.9 per cent in August.

A better than expected overall inflation reading during the month has offered a glimmer of hope for families who have been battling sky high prices for over a year.

Supermarkets ramping up price cuts and loyalty scheme offers – to compete with Lidl and Aldi- has also offered some relief for shoppers.

A grocery price war has been playing out before customers’ eyes over the last year with all major chains slashing prices to win the hearts of shoppers.

Helen Dickinson, chief executive of the BRC said: “Food prices dropped in the previous month for the first time in over two years because of fierce competition between retailers.”

“This brought year-on-year food inflation down to single digits and contributed to the fifth consecutive monthly fall in the headline rate, helped by easing cost pressures.”

Dicksion said she expects shop price inflation to continue to fall over the rest of the year, but warned that high interest rates, climbing oil prices, global shortages of sugar, as well as the supply chain disruption from the war in Ukraine, could pose a risk to this trend.

She added: “Retailers will continue to do all they can to support their customers and bring prices down, especially as households face being squeezed by higher energy and mortgage bills.”