Food and drink M&A drops as firms hold tight

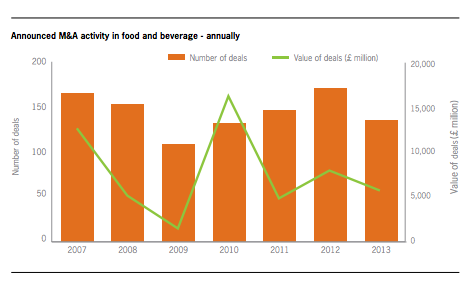

The number of deals in the food and drink sector fell for the first time last year since 2009, new research shows, suggesting companies are holding off on acquisitions to focus on strengthening their businesses.

Despite the broader economy showing signs of recovery, deal volumes dropped by 21 per cent compared with the previous year, while the total disclosed deal value for 2013 also fell by 28 per cent to £5.7bn, according to Grant Thornton’s latest findings.

At first glance this does not bode well for M&A activity in the food and drink sector this year. But the accountancy firm said that the headline figures obscure several underlying trends that have underpinned M&A activity in 2013 and which look set to continue in the coming months.

Firstly deal volumes in the sector did pick-up slightly in the last three months compared to the third quarter with the number of private equity backed deals increasing by 60 per cent in the same period.

This resurgence in private equity deals is even more evident when looking at the total value of M&A deals in the fourth quarter, which outstripped the third quarter by 284 per cent.

Grant Thornton partner and head of food & beverage Trefor Griffith said: “A number of the industry’s largest deals this year have been private-equity backed and with many firms now sitting on cash reserves that need to be deployed, we expect private equity to remain a key market trend in 2014.”

The top two deals in the last four months both featured private equity buyers.

There are other signs that M&A is heating up in certain parts of the food & drinks sector:

- Growing overseas interest in the UK food & drinks industry.

- Many large players are rationalising their portfolios – for example GlaxoSmithKline selling its Lucozade and Ribena to Japan’s Suntory – and this trend will be an important driver for deals in the coming months.

- Three drinks companies, including Stock Spirits and Conviviality Retail, made their UK market debut in 2013 and a number of trends suggest that activity in this sector, with the possibility of further listings, is set to continue.