Five reasons why energy transition stocks can weather the inflation storm

The current inflationary pressures putting strain on global equity markets are impacting energy transition equities more than most, with many of its sub-sectors right in the eye of the storm. But while these short-term threats are painful, they should not detract from the longer-term investment opportunity.

Inflationary pressures have been at the heart of this disruption. Global supply chain bottlenecks, rising input costs, concerns around the underlying health of the economic recovery, and the threat of rising interest rates, have created a very challenging environment for all industries around the world – and certain energy transition sectors are more exposed than most.

Disruptive dynamics are mostly short-term in nature

Although we believe the current supply chain tensions could last well into next year, they will eventually ease. Heightened raw material and shipping costs will trigger a supply response, which will relieve pressures on the costs of goods and services sold. Moreover, the underlying capital investment trends behind the transition to a net zero energy system remain incredibly robust, creating scope for significant order pick-up and returns uplift once near-term difficulties slow.

- Read more: Sustainable Investment Report Q3 2021

The long-term opportunity remains unchanged

While we remain cautious about the time it may take for the current headwinds to settle, the longer-term opportunity behind the energy transition remains firmly in place – and only gets stronger as economics improve, demand accelerates, and policy support grows. As long-term investors in the energy transition, using short-term disruption as an opportunity to buy is critical – especially given the underlying structural growth potential behind this particular investment space.

- Read more: Q&A: What is COP26?

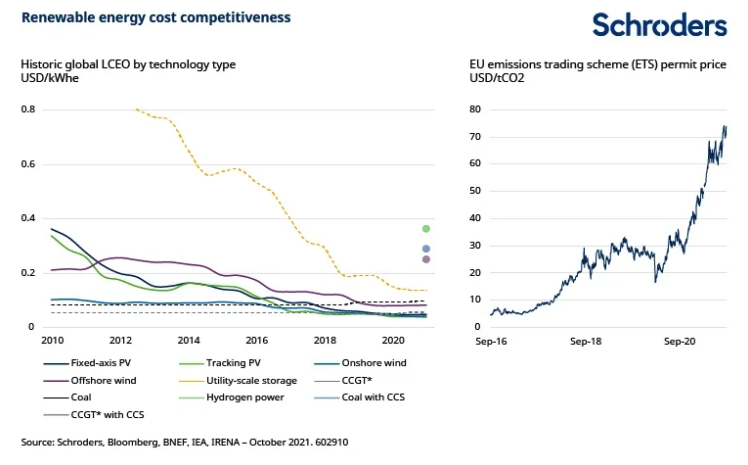

Competitiveness of renewable power remains incredibly robust

The cost of developing wind and solar projects has increased with inflation. But these increases pale in comparison to the heightened cost of both the commodity inputs for conventional power assets (for example, coal and gas) and the carbon costs operators of these assets need to pay to produce.

Moreover, renewables are only going to get more competitive as new innovations come to market. Historically, solar modules and wind turbines have seen costs improve at 28% and 11% learning rates (per annum) respectively.

While this rate of improvement will inevitably slow as incremental gains become harder to achieve, forward progress will still be made. Boosting power generation per panel and turbine means developers can deliver the same amount of electricity from a smaller-sized operation – which will be increasingly crucial as costs of land, construction, engineering and other equipment potentially start to rise.

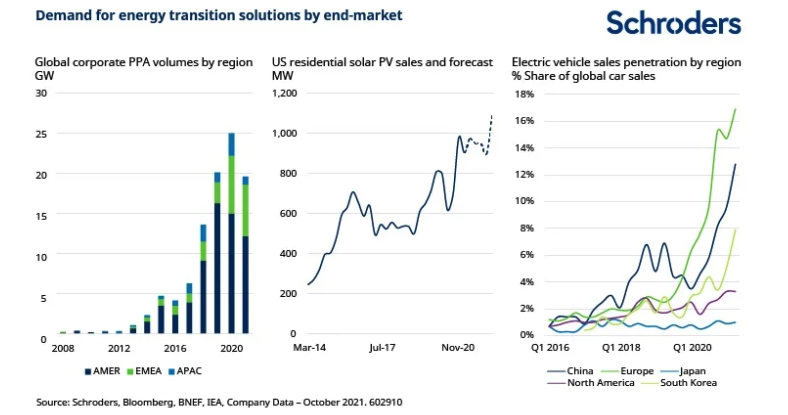

Underlying demand picture remains very robust too

Corporate demand for renewable power also continues to grow, particularly as more companies commit to net zero goals. Demand for residential solar and storage solutions remains incredibly strong, as concerns around energy security build and the economic benefits become ever clearer.

There has also been a remarkable pick-up in the demand for electric vehicles (EVs) globally, as new models are rolled out and consumers opt to go green.

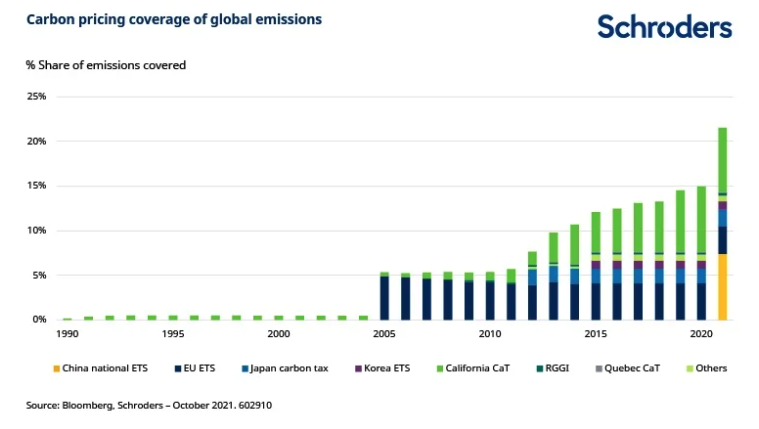

Policy support continues to move from strength to strength

Although President Biden’s infrastructure packages are currently stalling in Congress, it is more likely than not that this will be passed in some sort of amended form. Together with support from the European Union (EU) and the increasingly ambitious targets being laid out by President Xi in China, policy support behind the energy transition continues to build.

We have also seen exciting new traction in carbon markets. With China introducing its emissions trading scheme last year, over 20% of emissions globally are now covered by a form of formal policy.

– For more visit Schroders insights and follow Schroders on twitter.

Topics:

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.