Five high-quality European stocks for an ISA

By Rodney Hobson from interactive investor.

Our author and columnist offers some tips on choosing ISA stocks and identifies a handful of top picks.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner’s guide to the stock market. He is qualified as a representative under the Financial Services Act.

If you’re thinking of diversifying your ISA portfolio by investing in European stocks before the current financial year is out, take care. It’s not just that the fallout from Brexit will affect European Union countries as much as British ones. The growth spurt in the EU has fizzled out and even Germany flirted with recession.

Solid, growing companies with worldwide brands are usually the best options for an ISA portfolio, and that is particularly true at the moment in considering Continental companies. Look in particular for those with expanding markets, good cash generation and growing profits, even if that is reflected in the share price.

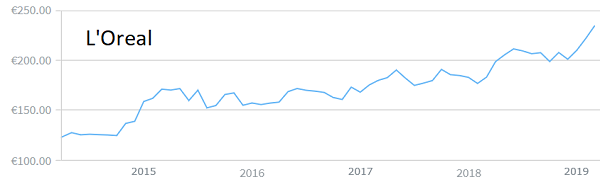

French company L’Oreal (EURONEXT:OR) is the world’s largest cosmetics company, with products in make-up, hair colour, skin care and perfume. It has also branched out into the fast-growing sector of men’s grooming.

Spending on beauty products is rising 4 per cent a year and there are major markets waiting to open up, most notably China where beauty spending has failed to respond so far to the nation’s belated move towards a consumer society.

L’Oreal has maintained relatively high returns for several years and demand for cosmetics continues to grow. It spends heavily on research and marketing and also on advertising to make sure its brand, backed by the attention-grabbing phrase “because I’m worth it”, remains in the public mind.

Source: interactive investor Past performance is not a guide to future performance

Such quality has admittedly been reflected in the share price, which has almost doubled in the past five years. After a slow start to 2019 the shares have started to move ahead strongly so the opportunity to buy may not last long. The price/earnings (PE) multiple is 34 and the yield is 1.5 per cent, not particularly attractive figures but you are buying quality.

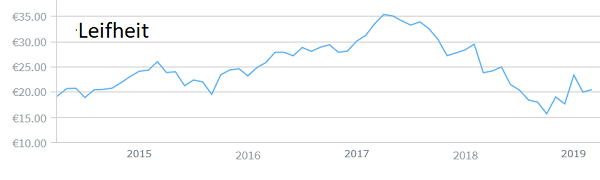

German engineering company Leifheit (XETRA:LEI) is a much less famous name but perhaps it is underrated. The German company’s kitchen and bathroom equipment such as mops, ironing boards and cleaning fluids are sold through John Lewis and Robert Dyas in the UK and by retailers across the world.

Unlike L’Oreal, it produces goods that we actually need, so whatever happens to the world economy its sales are underpinned.

The shares have slipped back since peaking at €36 in the summer of 2017, arguably too far, but they are showing signs of picking up again. At €22 the yield is an attractive 4.9 per cent.

Source: interactive investor Past performance is not a guide to future performance

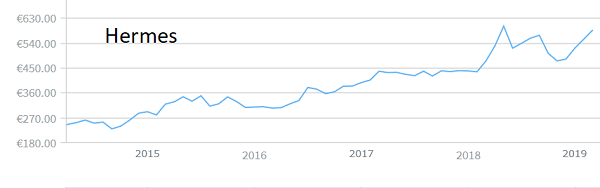

From the commonplace to the luxurious, we move to Hermes (EURONEXT:RMS), not the German-owned delivery company but the French high-end manufacturer in leather, lifestyle accessories, home furnishings, perfumery, jewellery, watches and ready-to-wear.

Like the products, the shares are not cheap, having risen steadily from €250 five years ago, but it is still possible to catch them below their recent peak of €600. Sales in emerging markets will continue to drive growth.

Source: interactive investor Past performance is not a guide to future performance

It’s an exaggeration to say Heineken (EURONEXT:HEIA) shares can reach parts of your portfolio that other beer makers can’t, but the Dutch company’s premium brands have caught the imagination of the aspirational classes around the globe. The world’s second-largest brewer saw beer volumes grow 4.5 per cent last year.

Admittedly, revenue in the second half was a little slower than the first and impairments took the edge off profits, but the underlying picture is one of progress, costs have been reduced and the dividend has been raised.

This has been another steady performer over the past five years and this year should continue the trend.

Source: interactive investor Past performance is not a guide to future performance

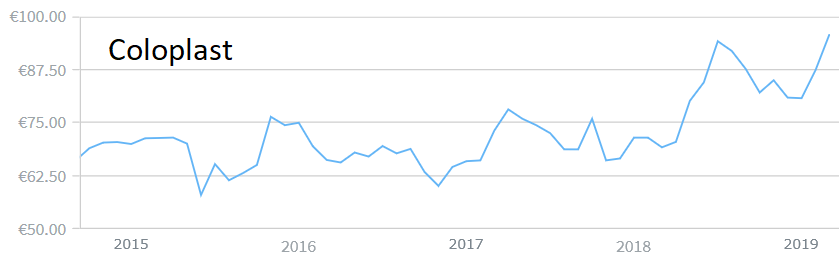

Coloplast (XETRA:CBHD)) is a Danish healthcare company making stoma bags and incontinence products, an area where demand will inevitably grow as we live longer. It reported solid growth in the latest quarter across all geographic areas, with sales up 8 per cent on a year earlier, a trend that the company expects to continue this year.

The shares are back to their all-time high but they still offer a yield of 2.24 per cent.

Source: interactive investor Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.