Fitch Ratings upbeat on UK housing market for 2016 despite slowdown in growth

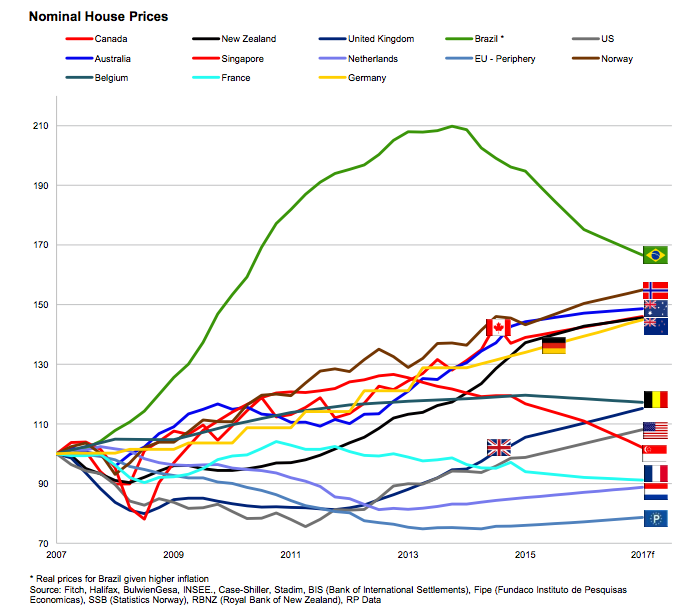

Credit ratings agency Fitch predicts house prices will continue to rise in 17 of the word’s 22 leading markets including the UK this year, buoyed by low mortgage rates, GDP growth and improving employment.

However the rate of growth is expected to stay the same or drop in most countries as housing affordability becomes even more stretched, Fitch warned, with Australia, New Zealand and Canada expected to see the sharpest deterioration in growth.

In the UK, Fitch forecasts price growth to slow from 9.5 per cent last year to around four to five per cent in 2016 as a supply of new homes fails to keep up with demand, with London and the South East modestly outpacing the other regions. The ratings agency said:

We expect already stretched affordability to weigh on any further home price increases, as income growth currently remains muted. Recently announced government initiatives around housing construction are not expected to feed through to housing supply until 2017 at the earliest, and in the shorter term, demand will continue to outstrip supply.

A rise in Interest rates remains the biggest risk and Fitch warns that affordability could worsen this year if mortgage interest rates rise. The ratings group expects mortgage rates to continue to fall to historic low levels in the first half before a rise in the second half in anticipation of a rate hike.

Overall the company said the housing and mortgage market outlook will remain stable or positive for most 22 markets it covers in its report, but downgraded its outlook for Singapore, Brazil and South Africa where it forecasts conditions to worsen, due to pressures including rising rates.

Britain was among the six markets it has upgraded from "stable" to "positive" since its last report including Spain, Portugal and Italy.