Weekend read: First-time home now have to stump up £33k more than before Covid hit

How much worse off are Britain’s first-time buyers now the pandemic starts to settle? Quite a bit, as it turns out, largely as a result of the post-pandemic property market boom.

A new analysis of first-time buyer house prices looked at the cost of purchasing a first home before the start of the pandemic in December 2019 and how it has changed today.

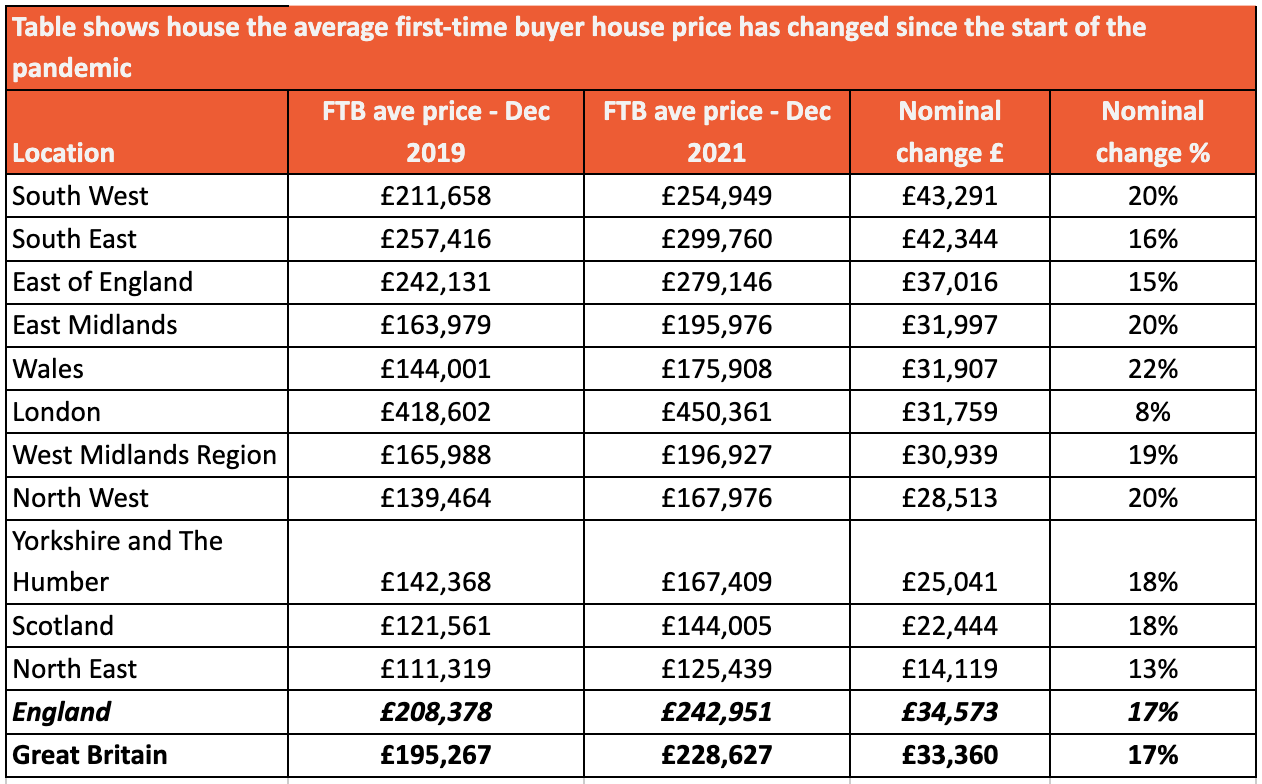

The research shows that across Britain, the average first-time buyer paid £195,267 prior to the pandemic. Today this has climbed to £228,627, a 17 per cent increase meaning they are now paying £33,000 more, according to the data from Stipendium, shared with City A.M. today.

First-time buyers in Wales have seen the largest percentage increase at 22 per cent, with those in the South West, North West and East Midlands also seeing some of the largest increases at 20 per cent.

The South West is also home to the largest monetary increase, with first-time buyers now paying £43,291 more as a result of the pandemic, followed by the South East (£42,344), East of England (£37,016), East Midlands (£31,997) and Wales (£31,907).

London

London has seen the smallest increase in the average price paid by a first-time buyer at 8 per cent. However, this increase does amount to £31,759, making it the sixth largest monetary increase.

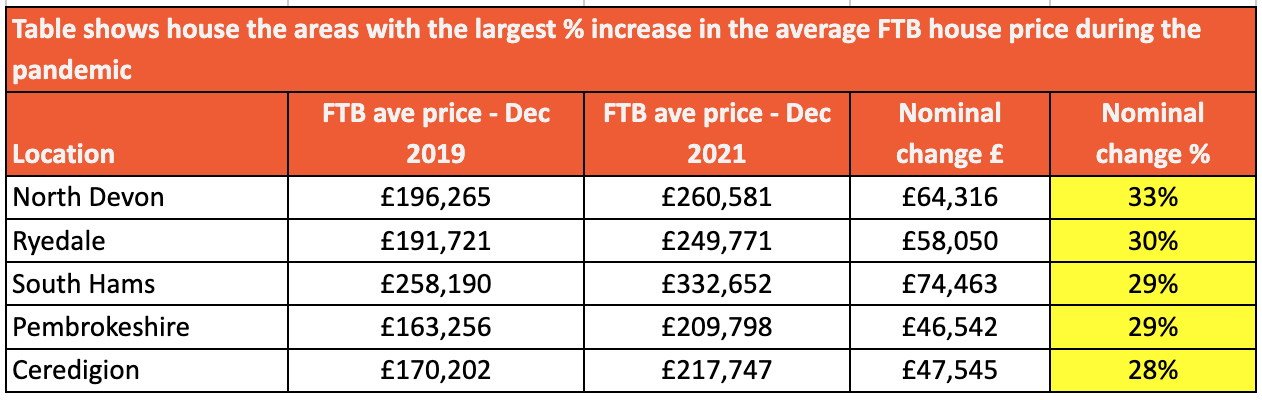

At local authority level North Devon has seen the largest percentage increase in the price paid by a first-time buyer at 33 per cent, with Ryedale (30 per cent) and South Hams (29 per cent) also amongst the largest uplifts.

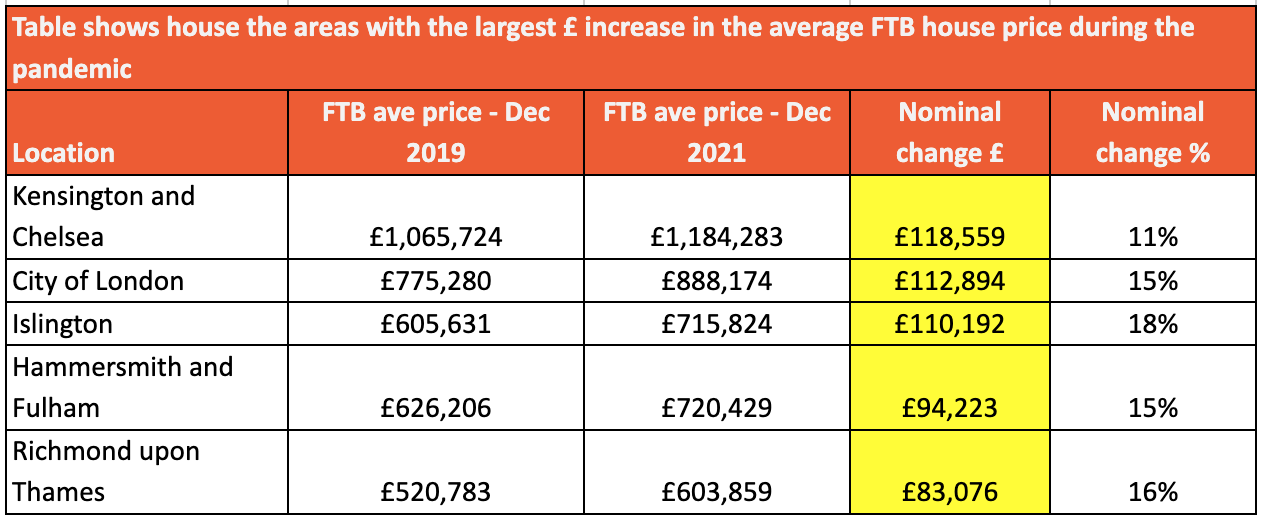

In Kensington and Chelsea, first-time buyers have seen the largest monetary increase, now paying £118,559 more compared to pre-pandemic market values.

“The pandemic property market boom has been widely regarded as a positive to be taken from an otherwise tough period and in some cases, this is certainly true,” said Christina Melling, CEO of Stipendium, as she discussed the figures with City A.M.

However, Melling pointed out that the introduction of yet another demand focussed government initiative in the form of the stamp duty holiday has only caused greater imbalance within the market, pushing the affordability of homeownership even further out of grasp for the nation’s first-time buyers.

While pre-pandemic life may seem a long time ago, the financial commitment for the average first-time buyer is now £30,000 higher than it was just two years ago.

“Unfortunately, until the government addresses the current housing crisis by actually building more homes, we can expect to see more of the same over the coming years,” Melling continued.

“All we can do in the meantime, is best educate those looking to buy their first home on how they can save money during the overall process and what to expect when looking to buy,” she concluded.