Firms slash jobs and hike prices as Reeves’ Budget fallout continues

UK businesses hiked prices and cut staff in January, a new survey shows, as firms continued to struggle in the wake of October’s Budget.

The latest ‘flash’ purchasing managers’ index (PMI), which reflects business activity in the private sector, showed employment levels decreasing for the fourth month in a row.

“Many firms suggested that the forthcoming hike in employers’ National Insurance had resulted in cutbacks to recruitment plans, while others cited the impact of a post-Budget slump in business confidence,” the survey said.

Excluding the pandemic, the rate of job cutting in the past two months has been the highest since the financial crisis, it noted.

Firms also battled a “sharp and accelerated increase” in the cost burden, which increased at the fastest pace in one-and-a-half years on the back of higher salary costs and energy prices.

This forced firms to pass on higher costs to consumers, with output price inflation rising at its fastest pace since July 2023.

Chris Williamson, chief business economist at S&P Global Market Intelligence, warned that inflationary pressures had “reignited”, creating problems for the Bank of England.

The survey’s price indices are indicating that inflation is turning higher again…the rise in price pressures hints that the inflation genie is by no means back in its bottle

Economists expect the headline rate of inflation to pick up to over three per cent by the spring, but the survey also suggests that services inflation could pick back up again later in the year.

Despite the problems facing businesses, output growth picked up slightly compared to December thanks to “modest growth” in the UK’s all-important services sector.

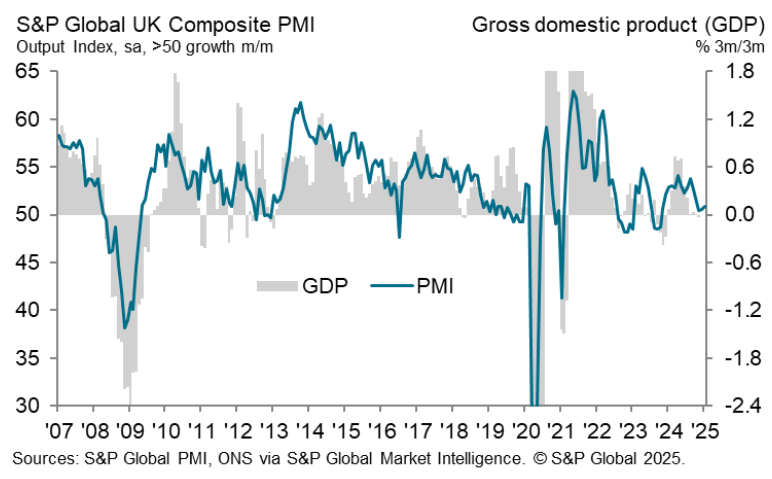

The overall index increased to 50.9, up from 50.4 the previous month and slightly ahead of economists’ expectations.

Nevertheless, the reading still only indicated a slight expansion and was comfortably below the long-run average of 53.6. The 50 mark separates growth from contraction.

“The improvement does little to move the dial on a speedometer which points to an economy that it broadly flatlining,” Williamson said.

The economy has been broadly stagnant since the general election last summer. Analysts at Capital Economics said the survey was consistent with GDP stagnating at the start of 2025.

Worryingly, the survey also pointed to further bad news down the line. Incoming new business fell at its fastest pace since October 2023 while business optimism dropped to its lowest level in two years.

“Today’s data release won’t alleviate the Bank of England’s concerns about the weakness of activity,” Elias Hilmer, assistant economist at Capital Economics said.

But the Bank will not be able to cut rates aggressively to support the economy while inflationary pressures in the wake of the Budget remain prevalent.

“All business surveys illustrate the same conundrum for the MPC,” Elliott Jordan-Doak, senior UK economist at Pantheon Macroeconomics said.

“Payroll tax hikes, global uncertainty and tariff threats are driving inflation and output in opposite directions. Growth is weak enough to warrant faster rate cuts, but inflation is strong enough to warrant caution,” he said.