Fintech firm Pipe secures $2bn valuation after funding round

Pipe, a startup that allows companies to sell their recurring revenue streams, has secured a valuation of $2bn (£1.4bn) following a fresh funding round.

The fintech firm today said it had raised a further $250m in a round led by venture capital firm Greenspring Associates.

New investors such as Morgan Stanley’s investment arm Counterpoint Global, SBI Investment and Creditease Fintech Investment Fund also contributed to the funding.

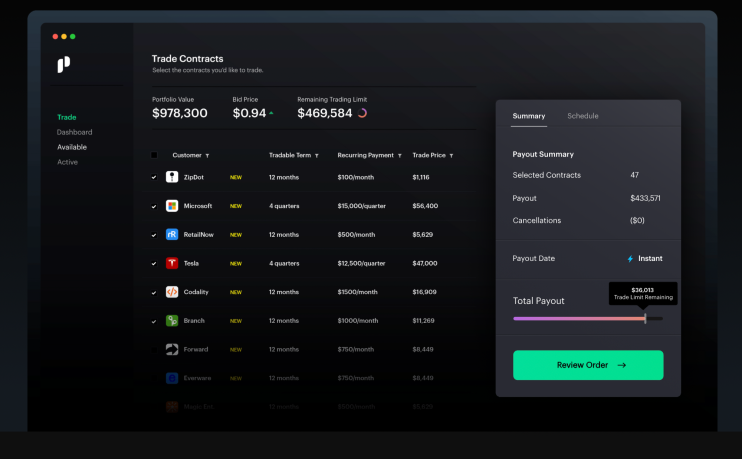

Pipe, dubbed the “Nasdaq for revenue”, operates a trading platform that connects investors with companies seeking to raise capital without dilution.

The Miami-based firm was founded in 2019 by Harry Hurst, Josh Mangel and Zain Allarakhia. It has grown rapidly since going live in June last year, with 4,000 companies signing up to its platform.

Just two months ago the company raised $50m from a host of major investors. Pipe’s latest funding round was oversubscribed by $100m.

The company boasts a string of high-profile investors, including Salesforce chief Marc Benioff’s investment fund Time Ventures and Reddit co-founder Alexis Ohanian’s venture capital firm Seven Seven Six.

Pipe’s platform has garnered significant attention during the pandemic as investors and tech companies look to alternative forms of fundraising and investment.

The firm today said it would use the fresh investment to bolster its platform and expand its product offering into new areas.