Fintech and the accountancy profession

The union of finance and technology as fintech has become pervasive, transforming how financial services are delivered and consumed.

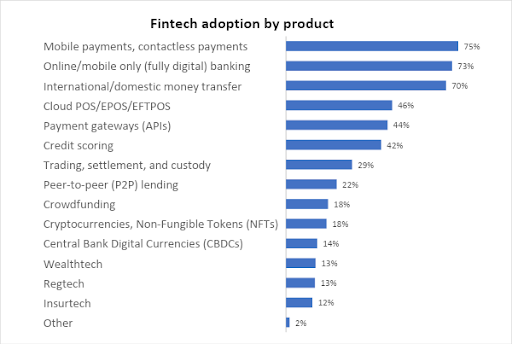

It’s a thriving sector with many diverse parts such as online-only or neobanks, peer-to-peer lending, payment gateways / application programming interfaces (APIs), investment banking back-end infrastructure, insurtech, wealthtech and regtech. And that’s before considering some frontier areas like central bank digital currencies, cryptocurrencies, and non-fungible tokens.

Accountancy and finance professionals need to engage with these fast-moving developments – which both disrupt and collaborate with the traditional financial architecture that powers our world – to deliver solutions that can be cheaper, more user-friendly and faster.

They can do this in a range of ways: fostering trust in the numbers underlying this still relatively nascent industry through audit and assurance, driving digital transformation or ensuring regulatory compliance to create new and exciting opportunities for themselves and their clients.

In late May, we’re publishing a report with our partners Chartered Accountants Australia and New Zealand, called Fintech state-of-play: Opportunities for finance professionals, which identifies the ten job roles for accountants within fintech. The report includes a global survey of over 5,700 accountancy and finance professionals which has found adoption to various levels across a wide range of fintech products and solutions

On careers for accountancy and finance professionals in fintech, half of survey respondents see opportunities ahead. But while roughly a further quarter don’t see career opportunities, they don’t categorically disagree that they might exist, possibly keeping open future possibilities.

We also illustrate how the accountancy profession adds value to organisations using case studies of accountancy and finance professionals performing 10 job roles with fintech such as CFO, financial controller and entrepreneur.

These job roles reveal an exciting, broad, and high-value portfolio of skills that professional accountants are already bringing into fintech. This ranges from understanding new business models, commerciality, and the ability to tell a compelling financial story to investors; to delivering much needed trust through assurance and clarity of financial information. They also bring a digital-first mindset that can operate without huge paper trails. And perhaps most crucially, they bring a flexible, creative and problem-solving approach to address new demands that may not have been tackled as much previously.

Fintech and ESG

One of these demands is the use of fintech for stakeholder and societal value, something evidenced during the pandemic. 74% of survey respondents agreed that Covid-19 had accelerated the use of fintech, emphasising how it’s imposed digital adoption in an unforeseen way and to an unprecedented extent.

Fintech can be a part of the solution on issues like financial inclusion by providing finance and payment mechanisms for those locked out of formal banking systems, something that remains a priority in the 21st century.

There are over a billion unbanked adults in the world, over half of whom are women. There is also the challenge of identifying genuine inclusion for example, where individuals technically have a bank account but don’t use it. It has no balance, is expensive to operate or inconvenient due to a lack of bank branches in remote areas.

In many parts of the world, fintech solutions like mobile phone-based payments have allowed for money transfers, though this is one part of a larger challenge and more progress is needed. Fintech can offer micropayments and cost-effective simple outcomes that are accessible to customers.

Fintech can also increase and improve financial literacy. A lack of financial experience, basic numeracy and literacy makes understanding financial transactions a challenge for many disadvantaged customers. In this sense literacy is the other side of the coin to inclusion. But a lack of education can also affect those who seem well educated or relatively well-off, such as not realising when taking on unsustainable amounts of debt. Some fintechs have entered the financial education space and are building businesses around increasing awareness among different demographics, such as targeting parents to help them educate their children on basic money management.

Understanding the way ahead

Fintech is being embraced by the global accountancy profession, but more can always be done. Our report recommends that the profession builds further awareness of the products and services within the fintech landscape globally and the competitive dynamics that will shape it.

Accountancy and finance professionals also need to understand the fintech regulatory landscape. In many instances, particularly for emerging areas like cryptocurrencies, there is an opportunity for those who can help to shape the standards and regulations.

All this must happen while embracing an innovation and purpose-driven mindset. Fintech is extremely fast paced, dynamic, and benefits from people who are excited about new ideas that can drive sustainable value; and who can pivot fast to changing business requirements.

We see governments and regulators joining forces here too – they need to jointly explore opportunities for common principles to underpin a multi-jurisdiction approach to fintech regulation. 78% of survey respondents cite the need for greater regulatory alignment between countries based on common principles. There are precedents, such as the EU’s General Data Protection Regulation (GDPR) covering all EU member states.

And we’d like to see governments incentivising more fintech innovation and growth. Governments should consider prioritising areas identified by accountancy and finance professionals globally such as building links internationally to learn best practices, working with education partners to improve skills and training, developing labs or sandboxes to support innovation, and supporting fintech as a tool for the development agenda to tackle challenges such as financial inclusion.

Fintech will continue to transform how the financial services industry operates. Professional accountants have huge opportunities in this exciting and evolving space.