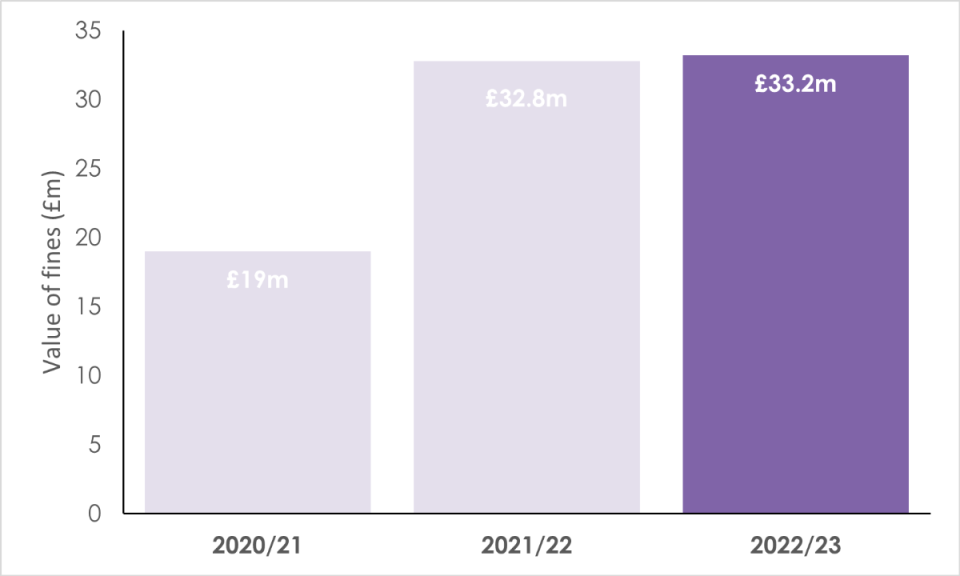

Financial Reporting Council fines against auditors nearly doubled in two years

The Financial Reporting Council (FRC) levied record-level fines against auditors over 2022/23 after it promised to become more “forceful” after it was heavily criticised for the slow pace of its investigations.

According to a report by Thomson Reuters, the accountancy regulator has fined auditors £33.2m in 2022/23, slightly up from £32.8m in 2021/22. However, the latest figure is nearly double that of the £19m recorded over 2020/21.

When the Financial Reporting Council’s costs were added, which the auditors have had to pay, the total penalties levied by the FCA hit £40.4m last year.

Over recent years the Financial Reporting Council has stepped up its use of fines as part of its efforts to improve the quality of audits.

This includes plans to drive higher standards by an audit reform, becoming the Audit, Reporting and Governance Authority (ARGA), which was deemed necessary to restore public trust following the collapse of several high-profile businesses including Carillion, BHS and Thomas Cook.

However, this proposal was shelved by the UK Government late last year and the anticipated transition date for the regulator was pushed back to 2024.

Speaking on on a Podcast this morning, Financial Reporting Council’s new CEO Richard Moriarty, explained that the FRC would like the powers of the audit reform earlier but he explained the regulator is happy that it has cross-party and stakeholder support.

He noted: “no one should be surprised that The King’s Speech was very limited, given it’s the last year of the parliamentary term and a topic like audit reform didn’t make the cut.”

“It would be nice to have these powers earlier than maybe otherwise the case, but it certainly won’t stop us in our tracks getting on with the important work that we need to do.”

“I am pleased that enhancing our powers does seem to have cross-party and stakeholder support and it is the case that we will continue to press, but what it won’t do is distract us from our day-to-day work of really enhancing public trust and confidence in audit, in corporate governance and financial reporting,” he added.

The FRC noted in November that it will look to focus on promoting “growth and the UK’s competitiveness” after the government shelved its host of reforms.

On the Podcast, Moriarty said: “I think the Financial Reporting Council has a good story to tell because by improving and enhancing trust and confidence in UK markets and UK companies, we’re able to really underpin investment in UK PLC.”

“However, what we’ve got to do, I think, is be really sharp in our focus that when it comes to regulatory expectations and requirements, they’re smart, they’re proportionate and they’re targeted,” he added.

As part of the regulator’s focus for the 2023/24 year, the Financial Reporting Council will be promoting the use of technology, with particular emphasis on digital reporting. The regulator will also focus on internal upskilling and training ahead of proposed regulatory reform next year.

Kyle Gibbons, head of global accounts for confirmation at Thomson Reuters said: Rather than risk fines, it now makes far more economic sense for audit firms to increase their rigour and technology stack. The sheer cost of fines issued in 2023 by the FRC demonstrates that the regulator is using serious sanctions to help improve the quality of audits across the industry in Britain.”

“The Financial Reporting Council took the decision that with ARGA being delayed it should not wait for the transition before it started a new tougher fines regime, and the FRC reporting an improvement in audit standards,” he added.

The FRC was contacted for a comment.