Federal Reserve and Bank of England set to tighten policy once again this week

The US Federal Reserve and the Bank of England this week are set to hike interest rates steeply again in a bid to chase down scorching inflation, investors are betting.

The two central banks are expected to look through recession fears and continue their fight against historic price rises.

Despite inflation dropping to 8.3 per cent across the pond, analysts have warned price pressures are starting to embed in the US economy, likely forcing Federal Reserve chief Jerome Powell and the rest of the rate setting committee to lift borrowing costs 75 basis points for the third time in a row on Wednesday.

Experts at Wall Street investment bank Goldman Sachs are backing such a move by the Fed, taking rates to between 2.75 per cent and three per cent.

But, the world’s most influential central bank will not stop there.

“We expect 50 basis point hikes in November and December, taking the funds rate to 4-4.25 per cent at year end,” they said in a note to clients over the weekend.

Figures published last week revealed core inflation is still running hot, coming in at 6.3 per cent last month, higher than Wall Street’s forecasts.

Analysts are worried that inflation, up until recently driven by international factors that the Fed cannot influence, is showing signs of being fuelled by high wage growth and domestic services businesses passing on higher costs to consumers through higher prices.

Similar dynamics are playing out in the UK.

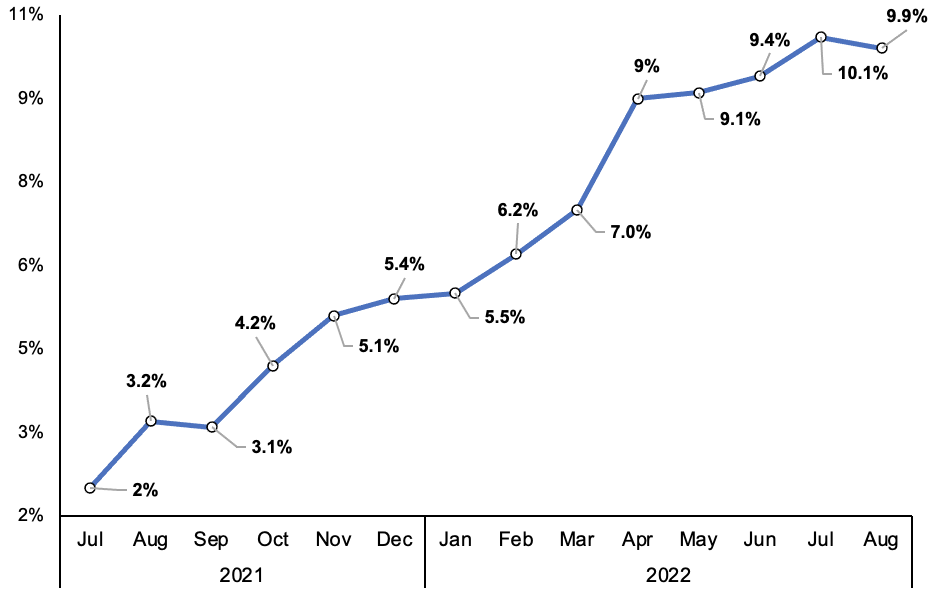

Inflation dropped from a 40-year high of 10.1 per cent to 9.9 per cent in August. However, core inflation also surprised to the upside, while the rate of price rises for services hit a 30-year high.

Annual UK CPI inflation

Markets expect Bank governor Andrew Bailey and co to lift borrowing costs 50 basis points to 2.25 per cent, but are betting on an outside chance of a 75 basis point move, which would be the biggest in the monetary authority’s 25 years of independence.

A steeper move would stem the pound’s slide against the US dollar and offset inflationary pressure driven by the government’s cost of living support package, “shoring up [the Bank’s inflation fighting credibility,” Sanjay Raja, senior economist at Deutsche Bank, said.